Christmas is over. The New Year crept in through a hangover haze and the presents have been packed off to the Sally Ann. Here in Vancouver, that means it’s nearly time for the annual Hys and Lows stock picking results dinner, or what I like to call The Rites of Poverty and Delusion. The dinner has assumed a prominent place in the hearts and minds of the hallowed members of our little club. And with that in mind, I know that you are excited to see the 2018 results (if you can call them that) so without further ado, I’ll cut to the chase.

Drum roll please…And the 2018 winner was… And the winner was… was… halted, that’s what the winner was on the last trading day of the year. Halted.

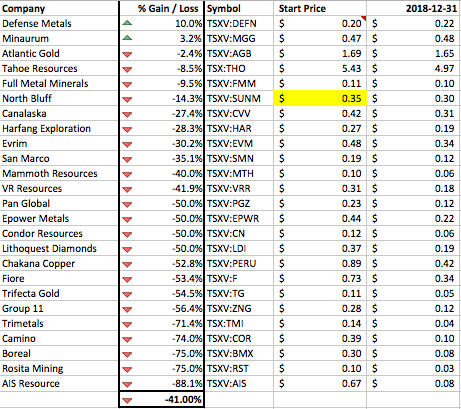

Defense Metals takes top honours in the table after being halted for the best part of 6 weeks at the end of the year. And under the guise of the stock halt, Defense’s management team was able to skip gaily past the tax loss carnage that affected everyone else. The strategy to winning the 2019 competition is now clear to me. Pick a dull-as-fuck stock that never trades, leave it well enough alone and hope they do no work other than a few corporate actions like a thrilling name change, and heaven forbid they drill anything.

Defense logged a stunning gain of 10% for the year. Ten percent. Ponder that for a moment kind reader. A reasonable cross section of 25 mining stocks, hand-picked and lovingly analysed, stroked and tickled by industry insiders with far too many degrees and MBAs between them, clever chaps all, managed a best performance of 10%. We should hang our heads in shame. Good God, even Trump gets better numbers than that.

As expected, the last turd down the bowl and around the bend was AIS Resources, which managed a very creditable decline of 88%. According to the blurb at the end of their news releases, AIS is an “issuer established in 1967, managed by experienced, highly qualified professionals, who have a long record of success in lithium exploration, production and capital markets. The company’s current activities are focused exclusively on the exploration and development of lithium brine projects in northern Argentina. It is currently exploring the Guayatayoc and Salinas Grandes salars.”

Which begs the question, if they’ve been at it since 1967, and if they’re so bloody experienced (at least 50 years each by now if my math is correct) why the fuck haven’t they found anything worth having, and how old are they anyway? But, after such a large decline you’d have to say AIS is probably a decent recovery pick for 2019 assuming their geriatric management live long enough.

Turning to the broader portfolio performance for a moment, we registered a loss of 41% on the year, with only 2 stocks in the green; Defense (10%) & Minaurum (3%). The average stock performance was also a loss of 41%, with the median falling about -50%. Basically, we picked the old man’s testicles of junior resource stocks. The longer things went on, the lower they went. And no, I won’t illustrate that with a picture. Even I have my limits.