Q. How to make a small fortune in mining?

A. Start with a large one.

This is an update to an article I posted a few months ago on urbancrows.

It’s an old cliché but very apropos at the moment. To put it in simple terms, the prevailing climate in the resource world I inhabit is beyond crap and has been for a few years. There’s been a slow, persistent drizzle of shitness scaring speculative money away. Investors have all but abandoned the mining and exploration sector. The TSX Venture Composite Index has drifted up a little recently, but the reality is, it’s simply inching its way slowly up from a 10-year low. The amount of investment capital available to the sector has shrunk, and as a direct result the pace of new mine discoveries has slowed to an historic low.

Do You Really Want To Do this?

Retail investors flit from one trendy idea to another, gleefully proclaiming each to be the future of equity investing until the bubble pops yet again. Don’t miss this one! It’s going to be bigger than Uber/Google/Amazon. Lithium. Graphite. Rare earths. Cannabis. Cryptocurrencies. Yadda yadda. If junior mining companies do release good news -a rarity, admittedly, these days- the sellers jump feet first into the trading volumes created and dump their stock, driving stock prices down rather than up.

A recent commentary piece in the Globe and Mail summed up the state of the business in Canada quite nicely:

“It’s no secret that the mining sector has been a bad place to invest for quite a while. The S&P/TSX Capped Materials index, which includes all of Canada’s major mining companies, lost more than 10 per cent of its value in 2018. That performance came after the index showed no gain from the summer of 2016 to the beginning of last year, as the overall stock market soared.”

My own experience as an active investor in mining stocks and other sectors mirrors this. I’ve made more money from dividend stocks in the last 12 months than I have from junior miners, with one exception, which was a new listing where I was able to buy some of the early seed stock (which doesn’t really count, if you ask me.) The mining stock picking club I belong to fared no better. Last year, our portfolio of 25 stocks registered a loss of 41% on the year, with only 2 stocks in the green. The average stock performance was a loss of 41%, with the median falling about -50%. Basically, we picked the old man’s testicles of junior resource stocks. The longer things went on, the lower they went. And no, I won’t illustrate that with a picture. Even I have my limits.

Optimist Schmoptimist. Must Drink More.

It’s true, there’s been a slight uptick in optimism in British Columbia on the back of a couple of recent deals, mostly Newcrest buying 70-odd percent of Imperial Metals’ Red Chris project, but sentiment remains miserable. We’re not happy.

Long term, you would have to think that this state of perma-crapness is a positive for mining investment. The wise-old-heads insist that a lack of discoveries, and consequently a dearth of new mines, is bound to follow hard on the heels of the current lack of investment capital in the sector. Eventually, commodity prices will rise from the dead as supply shortages kick in, so we should see a rebound in the sector. The question is, will any of us will live long enough to benefit from the rebound?

Pointers. If You Insist.

But if you insist on trying your luck in the sector, I’d be remiss if I didn’t give you a few pointers on how to select your next junior mining stock. After all, this could be the one; financial freedom beckons as Gobshite Resources Ltd hits the big one on its first drill hole, 200m of high grade gold, and lands you a 20-bagger. So here goes; the sum-total stock-picking wisdom I’ve accumulated in my lengthy mining career.

- Pin the stock pages of the Northern Miner or Globe and Mail to a wall and chuck a few darts to come up with 3-4 picks. Potentially painful if you drop a dart and you may have to redecorate.

- Assiduously read the bulletin boards on ceo.ca or Stockhouse.com where active investors post their comments, and make sure to believe everything that everyone says about your target company. After all, there can’t possibly be any hidden agendas on a chatboard now, can there? Rumours that the “big boys are sniffing around”? Buy. The inside scoop that the “results are delayed because they have to reassay the high-grade stuff”? Buy. What could possibly go wrong?

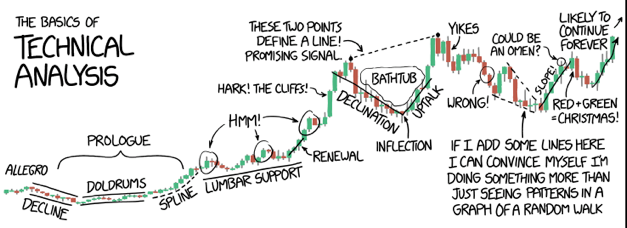

- Use complex technical analysis. This heavyweight science-based approach looks at stock chart trends and breaks it down into mysterious chunks with fun names like reverse head and shoulders, falling wedges and breakaway gaps. The more of these you can spot, the better the stock. Here’s one I found that takes a deep dive into analysing a junior.

- Steal someone else’s pick. Good tactic this. Wait until a friend tells you what they’re investing in, piggyback off the research they’ve done, and simply copy their idea. If it fails, it’s their fault and you can shout angrily at them.

- Choose any US listed gold stock with the word Patriot or American in the name -preferably both- and that has an American flag on the home page of the website (especially one that’s actually waving in the wind), and wait for Donald Trump to rile up the MAGA grey hairs again. Plus, the meerest mention of a return to a gold standard, and the failure of fiat currency, will drive your stock up like a SpaceX rocket.

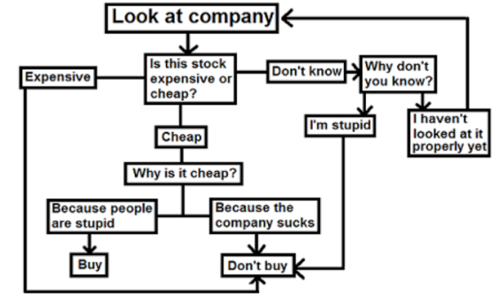

Flow Charts Are Always Good.

And if that list should fail you, here’s another guide. Part of our mission at urbancrows.com is to help you forget the day-to-day, and make your life easier. So if you are actually thinking of investing in junior mining stocks, and I haven’t yet put you off; should you wake up tomorrow and find yourself overcome with the urgent desire to piss your hard-earned money down a massive, stinky sewer while self-flagellating with thorn twigs, here, courtesy of the must-read IKN mining blog, is a flow chart to guide you through the simple process of shrinking your fortune. We wish you good luck.

This is an update to a piece I posted a while back on the Urbancrows blog.

Very good. I too feel the chill wind of mortality outrunning my limping portfolio.

‘Meerest’? I may be wrong but I think it should be ‘merest’ unless you are a meerkat and you aren’t.

yeah, rodent, geologist… all the same.