Stock picking club update

What follows is an edited version of my monthly junior mining update to the members of the carnivorous stock picking club informally known (for this month anyway) as the “Lows and Lowers”. The usual disclaimers.. all names of members have been removed and some of my more abusive comments have been diplomatically edited out. The update is firmly tongue in cheek so don’t take it personally if you work for one of the companies I’ve mentioned. Consider it a free daily dose of sarcasm. PS: may involve swearing.

So here we go…

Greetings Stock pickers,

I’ve just about recovered from the trauma of watching Liverpool beat Spurs in the God-awful Champions League final. As one wag on Twitter noted, he chose the wrong game to introduce some American friends to footie. Can you imagine paying good money just to see 2 top-flight teams stand around for 90 minutes, trying desperately not to get a shot on goal? Things were briefly livened-up by the appearance of a Spanish-style streaker. Beats the usual fat, red, drunk bloke from Newcastle that we English always seem to get in EPL games. Doesn’t the security guy look happy?

We’re fast approaching the official end of Spring, drifting lazily into June’s warm embrace. Investors in the junior mining sector have fully bought in to the “go away in May” rule-of-thumb. Sell your junior stocks, and come back in the Fall when the flow of crappy drill results begins to hit the news wires.

Just Burn It

But, our astute group of members -always ahead of the curve- has noticed the less-than-subtle shift to a new variant; “Go away in May and fuck off for good.” Don’t come back. Ever. Buy weed. Buy dividends. Buy black BMW X5s and send them to China. Burn your cash in the garden –whatever- just avoid junior miners. Not so fun.

The end of the month was notable for the Trump effect on gold. His if-it-moves-slap-tariffs-on-it policy, liberally applied to every country that currently imports widgets to the US, plus a few that don’t but might in the future, had an unfortunate effect on the big indices, but the opposite effect on gold. My portfolio of dividend stocks has taken a decent reaming recently but at least yields are up. Silver lining and all that.

What Luxurious Hair

The TSX gold index was heading to a slight loss on the month until yesterday, when up it popped up like the front of the Donald’s luxurious, silky orange hair in a light summer breeze. Or perhaps like Boris Johnson’s glorious leonine mane. (I’m praying for a windy day if they meet in England this week..) The index closed nearly 6% up on the month, most of the gains coming last Friday, which had an immediate positive impact on our stuttering portfolio. However, the Venture composite index is still stuck in the doldrums, drifting slowly along on low volumes waiting for a puff of wind to get it going again.

In a spirit of contrarianism, I believe the TSX-V has been unduly impacted by the City and is about to recover. Not the City of London. I mean Manchester City. Now that the Blues have finished their season (league, competitions – the lot) our Man City-fanatic-fund-manager friend can devote his considerable intellectual capacity to investing again. So expect his nascent fund to deploy a lot of capital in the off-season while City take a rest. Now’s the time to pin him down on that long-planned meeting and private placement, just don’t mention the Champion’s League. Come the August pre-season games, volumes will drop again. If the Blues have a bad start to the season, expect his shop’s financing mantra to change to “2 full warrants 5 years”. You have been warned.

On To The Results For May

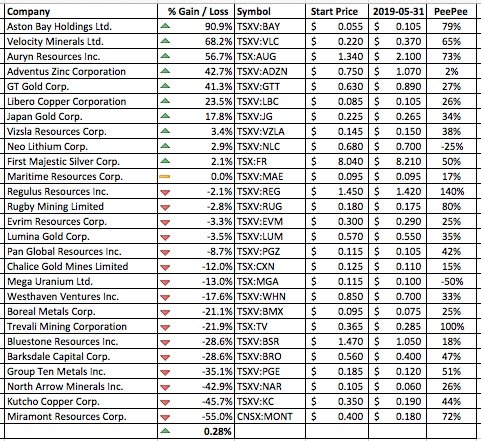

Enough frivolity. On to the May “progress” report; all the news that’s worth hearing from the anals of the World’s Greatest Mining Stock Picking Club. Yes, it’s true, the eyes of resource investors around the globe continue to stare, unblinking and red with envy, on our elite troupe of 27 junior resource stock-picking monkeys. Here are the standings:

How did we fare in May? Slightly less shit than April. Did we outperform the market? No. Is the portfolio in the black? Hmmm.. break even at 0.3% gain on the year. Will we improve in June? On past performance, highly bloody unlikely, unless Trump continues his tariff wankfest or John Bolton finally gets to act out his nightly wet-dream -a war with Iran- thus pushing gold to new heights.

This month’s box score was 10-1-16; small improvements in every category over April’s (7-3-17). The cling-ons at the bottom of the table are unchanged. Miramont is still bottom, down another 5% at -55% on the year so far. Kutcho Copper is comfortably settled in for the long-haul at second from bottom –slippers on, pipe lit, feet up in front of the fire- down 46%.

Personally, I think next year we should run the club like the football league in the UK. The bottom 3 pickers get relegated to a new second division and have to provide 2 bottles of wine at the dinner until they win the B-league and promotion back up.

And The New Leader Is…

It’s all change at the top, with a quite remarkable Hail Mary leap from 17th to 1st place by Aston Bay Holdings. They turned a 9% decline into a 91% gain in one month on no news. Zero. Fuck all. Mafeesh. On April 30th they announced the stunning completion of 878m of core drilling at their Buckingham gold project. (I had to sit down while typing that.) Results were/are anticipated “in the coming weeks”. So a lab turn-around of close to 5 weeks to date? Hmm. Judging by the big uptick in volumes in early May, someone’s been running some promo somewhere. Either that or a savvy chappy has “anticipated” the results slightly more accurately than Joe Investor. Suspicious? Me?

Last month’s leader, Auryn, has slipped back to 3rd place behind Velocity Minerals. Velocity staged a very respectable uptick from 27c to 37c on the month and may actually challenge for the lead in June. Watch this space. My own pick, Chalice Gold, dropped a cent, with no news since April, and bugger all trading; proof that having cash in the bank, and regular pay checks, inspires corporate inertia. It’s also interesting to see Mega Uranium at 11.5c, down 13% on the year so far, a long way from their $8 Halcyon Days 12-odd years ago. Where’s Jim Dines when you need him, eh?

Yes, It’s Silly Season

In other news, silly season has started on social media judging by the Twitterverse reaction to recent exploration news. Sun Metals announced it was kicking off its 2019 campaign, eliciting some breathless reactions on Twitter:

“..wow didn’t know crews were already mobilized… $5.4 million exploration program in Canada! Wow! “

Fuck me. And lots of Wows thrown in. I’ve been doing something wrong if announcing the start up of your annual program is all it takes to get people hot and horny for a junior miner again. Jeez, you’d think they’d hit already.

Some users of social media have also taken to describing the President of Sun as a “genius” geologist. Let’s just say, I’m not so sure that the label genius is appropriate after drilling a single good hole. If it was, most exploration geologists who’ve ever drilled a project could justifiably say they’ve had 140+ IQs at some point in their careers. Alas, for me it was a fleeting 15-minute brush with mental acuity, then a rapid reversion back to my normal state of 100% dumbass. I drilled a hole in Iran in the mid-1990s that ran 10g/t Au over 50m, and spent the next 2 weeks rationalising Quantum Mechanics with the Theory of Relativity. It was a dry camp, what can I say?

Seriously though, I think you need to have made multiple economically-viable mineral discoveries before you can be labelled a genius in this business. A good place to start the genius-hunt is by Googling the name Hans Merensky.

Before signing off, let’s take a quick gander at Maritime Resources. Bucking the accepted PR wisdom, they’ve gone all industrial on their website. Eschewing photos of mountains and the great Canadian wilderness, they instead plump for a fetching picture of a grotty conveyor belt sat in front of a pile of grey rubble and some electrical wiring. An honest approach, I guess.

If visitors haven’t immediately bounced off their website, things are not improved by the tag line “Developing the former high-grade Hammerdown mine”. Does that mean it’s a former mine or was it formerly high-grade, but now it’s tomb-stone? No matter. Sprott are a shareholder so I have faith. The dismal photos of flooded holes continue in their website gallery:

Maritime’s share price has remained immune from the recent market shenanigans by simply staying below 12c and refusing to come out since mid-2017; a whack-a-mole game with no mole and precious little whacking. Very clever boys, but surely this is a warning sign? Nothing’s happened for nearly 3 years, so why now? Why this year? And with 279m shares fully diluted, including 90m warrants and options, is there ANY news at all that could pop this one far enough to get you to the top of the Hys and Lows table? Is the member who picked this totally mad?

They did manage to raise over $6m this year -nigh on miraculous in this market and kudos to them -to fund exploration of some imaginatively named targets: Rumbullion, Golden Anchor and Whisker Valley. They also claim to have 90,000 acres of exploration ground. Nice trick that, using acres to get a bigger number than the Canadian standard hectares (36,400 of them). Again, clever chaps for making the best of the hand they’ve been dealt, but I fear it won’t be enough to help our man “St Olav” the Patron Saint of 9c Stocks.

Interestingly, the real St Olav was a bit of a lad, and partly responsible for the widespread adoption of Christianity among the Vikings. This must have taken some cojones:

“Now look, Halfdan, please put down that huge bloody axe and listen to me. It’s time to put on this cross and love thy neighbour. Plus you can only have one wife. Yes, I’m serious. Ouch. Stop it.”

I’m guessing his proselytizing corresponded to the phasing out of traditional Viking “pillage-then-burn” model of economic exploitation (remember, not the other way round) of neighbouring countries (a methodology that still exists, though now it’s disguised as a $1-trillion sovereign wealth fund.) St. Olav remains revered and central to the Norwegian national identity to the present day.

And that’s it for another month. Please don’t treat these updates as investment advice, given our dismal track record. As ever, I welcome comments, and if you like what you’re reading, don’t forget to subscribe to urbancrows.com via the underwhelming little subscription box on the home page, if you can find it. I promise not to spam you, but I will let you know whenever I post new content.

Next up for the stock picking club, June Jaundice. Can’t wait.

Ex-Chairman Ralph

I know you can be a bit arsy, but ‘the anals of the World’s Greatest Mining Stock Picking Club.’?

Excellent reading as per usual!

good lord, you spotted that?

Hi Ralph – This is excellent and had me laughing out loud, especially that conversation with “Halfdan” and the comments about Maritime and their website. (Too true.) I’ve enjoyed reading your blog, especially that post about the types of Geologists, me being married to one. So yes, I filled in that underwhelming little subscription box and confirmed I’m a human. Looking forward to your next post. Cheers, Marthe B.

Many thanks for the kind words Marthe. The blog has drifted a bit closer to mining than I originally wanted but it does appear to be where the main audience lies for me. Sigh.