The Final Results For 2019.

First: The Rules

It’s time for the year-end results of the Hys and Lows resource stock picking club, where world’s greatest mining minds come together to show how little we actually know about our business. This is an edited version of my end-of-year note to the club members. Sadly, I have to redact names to protect the innocent and throw the paparazzi off our scent. The unedited version is WAY more abusive and fun.

As you may know, we meet in late January to drink wine, eat steak, talk about the industry, and when we’re good and drunk we each pick a mining stock. That’s about it really, other than taking a guess on the 12 month performance of the overall portfolio.

Christmas Was Fun

I spent Christmas in Tofino in an over-warm cabin with my family, the in-laws, and my smelly, arthritic Wheaten Terrier who wheezes like a pig with clogged sinuses.

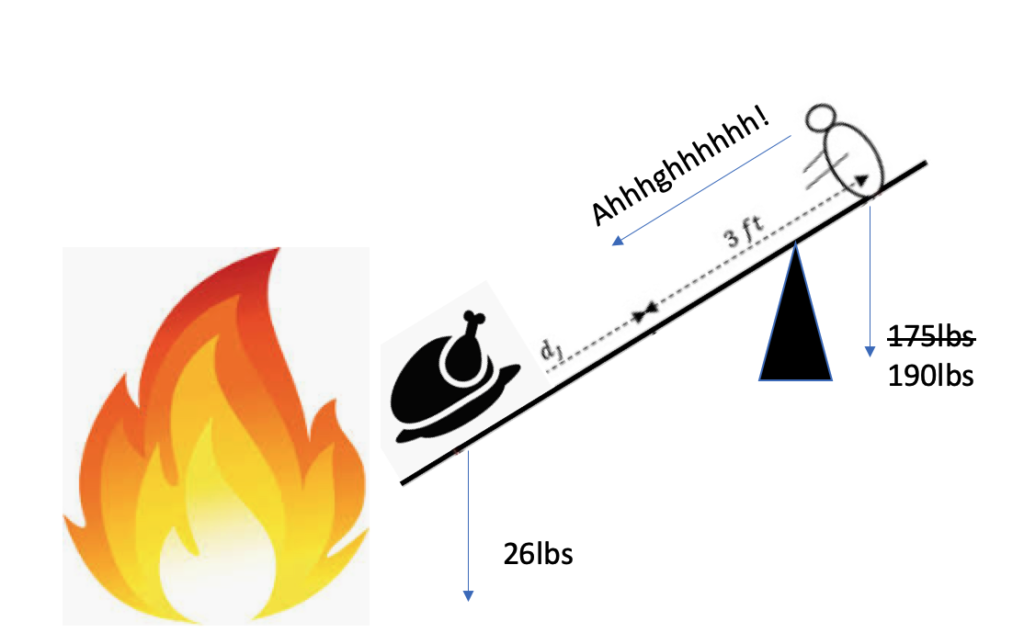

The resort gave every cabin a turkey. I was looking forward to our delivery, naively expecting an 8-10lb bird, right up to the point that I saw what was coming our way. Two beefy male staff carrying not so much a large turkey, more a slightly stunted ostrich fresh in from Kenya. Twenty six pounds (yup, 12kg) to feed 6 of us. Our left overs’ left overs had left overs if you get my drift.

The family disappeared for a pleasant 2-hour stroll up Long Beach to exercise the phlegmy dog, leaving me to handle 5 hours of roasting on my own. Fair enough, I did volunteer. But have you ever tried getting a 26lb bird, roasting merrily at 375°F, swimming in a lake of scalding hot lava juice, out of an oven solo without needing skin grafts afterwards? Take it from me, it’s impossible.

Basic Physics

The first time I tried to baste the pterodactyl I made the mistake of trying to hold the roasting pan by the corners, something I instantly regretted as the basic rules of physics (viz. levers and fulcrums) kicked in. The dead weight of meat won and I toppled violently forward, head first toward the hot oven rack.

In an effort not to drop the fucker, I salvaged the situation by applying desperate, painful pressure with the ball of my right thumb against the actual metal of the pan to stop it dropping further. This selfless move allowed me to heave dino-bird onto the stove top for a jolly old basting. The second time I tried, I’d learned my lesson and reached in to grab the middle of the pan edges, promptly burning my knuckles on the side of the oven.

And that, kiddies, is how Christmas was saved! Well, that, some gauze and a lot of red wine.

What fun I had. If anyone needs some turkey, let me know, I still have lots.

But I digress.

It’s Hys and Lows time.

The race is run; the winners and losers decided. Preparations are underway -ably stick-handled by last year’s Chump and current Chairman for the biggest social event on the Vancouver business calendar; the Hys and Lows gala awards night. The Annual Rites of Poverty and Delusion.

This invitation only, exclusive white-shirt-with-red-stain event is watched with jealous awe by the “deplorables” aka the rest of the Vancouver mining crowd. Every year we have a full room of 25 peeps, this year no different.

Get On With The Results, You’re Boring Me

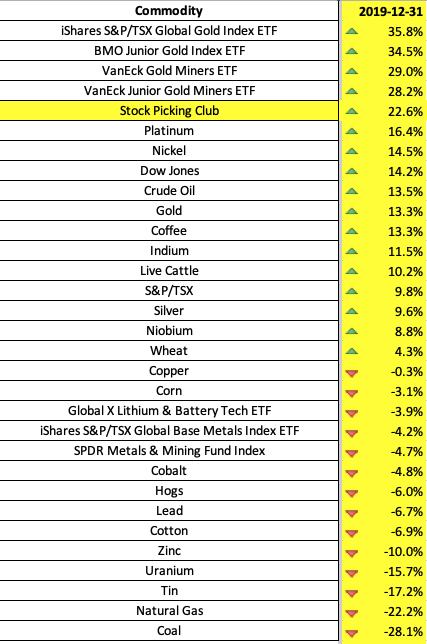

Our portfolio finished with 15 gainers and 12 losers, and an overall gain of nearly 23% fucking percent. Holy shit. A 64 point turn around from last year’s 41% decline. I’ll take that. Over the 12 months the TSX was a paltry 9.8% (Gain? GAIN?? I spit on your 9.8%). How do we compare to the other key indicators?

There you have it. On a par with the Van Eck Jr Gold index. It should now be obvious to any resource investor with half a brain that they merely need to follow us. Hys and Lows IS the new benchmark in resource indices. Our fund manager friends can abandon technical analyses completely and buy our list of stocks; plus we’re cheap, really cheap. We’ll take 1 and 10. No, we’ll take 0.5 and 5, come to think of it. Imagine how many more days off you can take while our gilt-edge-cannot-fail portfolio ticks along on autopilot looking after your clients.

The TSX global gold index was up 36%, well and truly rubbing our self-congratulatory noses in the cow shit. Gold was up 13% over the same time frame.

And The Winners Are…

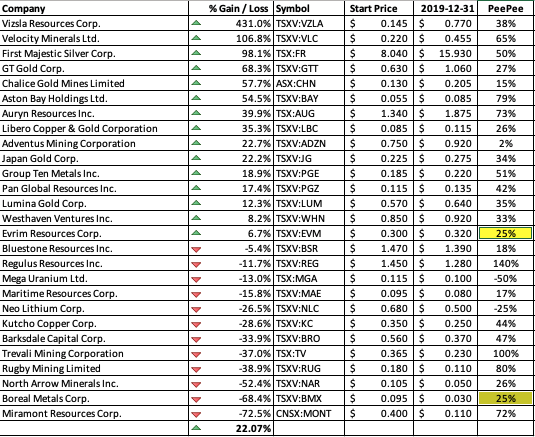

Who’s top of the stock picking dog pile for 2019? It galls me to say it, but once again it’s last year’s champion picker. Two years in a row. Shit that hurts. This year he randomly chose Viszla Resources, which triumphed with a truly shocking gain of 431% on the year. It climbed a further 11% on the final day to seal the No. 1 spot. I guess he’s probably relieved to be getting a free meal after all the buying he’s been doing to keep ahead of the pack.

Despite announcing NOTHING, NADA, NICHTS, RIEN, MAFEESH, AZIKO (I’m all out of nothing words now) of substance in the last quarter, they sport a pant-bulging market cap of over $30m. The next quarterly financials should be interesting. Let’s see what the number is for IR under the G&A expenses. Might be up a bit from the last quarter’s $8k. Newsletters don’t come cheap.

I feel I should remind the club members that he has a curious and borderline illegal talent for picking unconventional winners. Last year his pick, Defense Metals, robbed me and Evrim of my rightful win at the last gasp and took top honours after being halted for 6 weeks. Their management team was able to use the halt to slither snail-trail-and-all across the line, the banana slug of stocks, avoiding the tax loss selling and prompting a vital Hys and Lows rule change.

The Also Rans

Second place went to Velocity Minerals, up 107%. Velocity was flirting with the top spot for most of the year but went for the money shot a bit too early in the movie.

At the bottom… drum roll please… we all know who it is, don’t we? If ever anything was pre-ordained for 2019 it was that Miramont would come bottom; the dried up gum clinging on to the bottom of Viszla’s shoe. Despite a minor last minute fight back to a mere 72.5% loss on the year, they sucked the hind tit bigly. MONT briefly tickled second-to-last place Boreal Metals’ gonads (down 68%) in December but in the end wisely avoided interfering with Boreal’s pendulous plums.

MONT’s last substantive news release of the year was a cheery announcement by Dr Quinton Genius that although they’d terminated 3 option agreements somewhere, their Lukkacha project in Peru was advancing convincingly towards granting of the rather Star Warsy sounding Supreme Decree.

Mr Loser: Er…yes. Help me, please.

The Toilet Seat Of Shame

Our last place picker gets to don the toilet seat of shame while reading out loud some carefully chosen words of ritual humiliation. Cameras out boys, I feel a GIF coming on. And what a social media meme that promises to be. Twitter, Instagram, Facebook, Junior Mining Network.. the Vancouver Sun, AMEBC.. Kitco…so many websites, so little time.

The Top Performing Commodity

We picked a rather curious collection of commodities including Yttrium, selenium and a whole load of other shit that it’s hard to find a price quote for without a Bloomberg terminal surgically attached to your head. The big loser was thermal coal with a decline of 28% on the year, and well done to one of our mining analysts who picked the black stuff for once again demonstrating that, as the post-carbon economy barrels toward us, qualified professional mining analysts are as useless as the rest of us.

The top performing commodities were precious metals, in this order: platinum, gold then silver. Platinum finished up roughly 20% and was the commodity pick winner. Seven members went for silver, and 2 for gold. Well done to them. I knew there was at least one precious metal fan out there who doesn’t keep 3 years’ supply of pickled pigs nuts and dried squirrel meat in the shed next to grammy’s mummified remains.

So that’s it. I’m off to find a new stock for 2020 and rinse out my liver for the dinner. I also need to bone up on insults to hurl at the active pickers throughout the evening, remembering that you can’t be too personal with this crowd. Kids, genitalia, deformities… it’s all fair game.

Happy New Year,

Ex-Chairman Me

Don’t Forget

This is NOT investment advice. Lord knows, a sack of rabid cats dumped on the stock charts could pick a better portfolio than ours. If this piece hasn’t put you off my blog for life or prematurely forced you into a care home, please subscribe to urbancrows.com via the cheap and nasty subscription box that I artlessly chucked in near the top of the page. I’ll be sure to email you more excrement about the junior miners from time to time, and I may even mention names. Weddings, parties, anything. Capiche?