I promised myself when I started urbancrows.com that it wouldn’t become a mining and exploration blog. I was determined to keep it broad-ranging, stuffed full of erudite and amusing articles covering everything from wildlife, classical music to ancient sex toys. It would be an intellectual bootcamp for me- and Lord knows, I’m mentally flabby – where I could build a careful façade as a funny polymath. Yeah, not quite.

As I feared, it’s beginning to drift inexorably towards articles related to my career in the junior mining sector. So once I’ve written this piece, I’m going to swear off mining until at least the end of February, most likely till the giant PDAC booze-up-disguised-as-conference in Toronto which always generates some interesting stories. But on with Hys and Lows.

It’s a wrap! The biggest event of North America’s mining social calendar, our annual Hys and Lows Stock Club dinner, has come and gone for another year. Except we’ve officially given up on Hys steak house. They wanted $50 per bottle corkage and we could only bring 6 bottles, so screw them if they don’t want our business, and thank you to the accommodating Black and Blue on Alberni. But we’ve kept the Hys and Lows name. Black and Blue and Lows isn’t very catchy, although it does invoke the shit kicking we took last year..

With the tables cleared, and the bottles of red wine drained, the spreadsheet of chosen companies (aka. The Few, the Lucky Few) is compiled and there’s nothing more to do but wait for the market to fuck us over again. It’s hard to believe things could go worse than last year’s competition.

For he to-day that picks his stock with me

Shall be my brother. Henry V. Really.

We changed things up this year; the secondary poll to predict the peak gold price for the year has been scrapped because it’s really boring. A barbarous relic, perhaps. Instead, we’ve introduced the decidedly more fun PeePee guess, or, “What will the overall Portfolio Performance be?” To my mind, it’ll be a better measure of who’s really optimistic about the junior markets, and who’s already on the window ledge getting ready to jump.

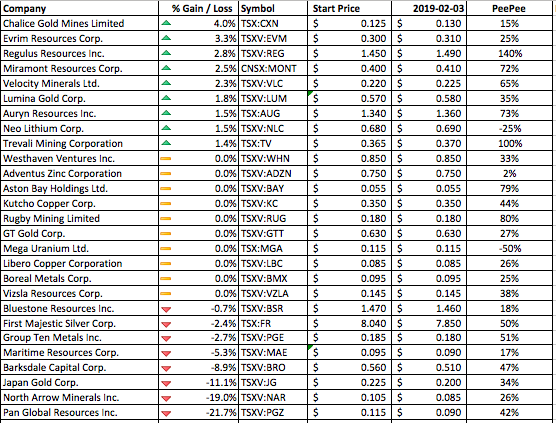

Our revered group chose an interesting range of companies, and the full range of stock picking techniques was on show during the evening. Everything from detailed analysis of companies and their projects with reams of notes (why oh why..), through the odd hint of insider knowledge perhaps, to the I-don’t-give-a-fuck-let’s-go-random, which appears to have been the preferred method. Our “year” ends the last trading day of 2019. Here’s the full table of companies chosen by our group, names redacted, as the pick of 2019 junior resources. Ha ha ha.. did I say pick?..sorry..don’t know what came over me.

We’re off to a great start, down nearly 2% already on Friday after only 24 hours. Brilliant.

In a true “How boring can we be?” moment, the bulk of the portfolio, 11 of 27 companies, is (still) made up of gold explorers, with 7 picks chasing copper discoveries. That probably reflects the dominance of gold and base metal stocks amongst the Canadian-listed juniors, mixed with some optimism that the gold price is moving up, or perhaps club members revert to what they know when asked to choose. Or maybe all three. There are only 2 producing companies; Trevali (zinc) and Boreal metals (zinc). My guess is, we avoided producers because the group believes that discovery will yield higher share price multiples than boring old production.

Three wild and crazy members avoided gold, silver or copper altogether and plumped for something more offbeat; North Arrow (diamonds), Group Ten (platinum group metals) and Neo Lithium (er…lithium).

The most optimistic PeePee guess was a whopping 140% gain for the year, versus the gloomiest at a 50% portfolio loss, which would imply an even worse year than last year FFS. The daftest name award goes to Vizsla Resources which appears to take its name from a large, orange Hungarian retriever dog.

Yeah, IP should work well combined with soil sampling. Woof.

The website dogtime.com tells me that the Vizsla

“..has an aristocratic bearing. All he really wants, though, is to be loved. He’s a super companion.”

Amazing. Could’ve been written about me.

So there you have it. My in depth analysis of the table is done, and we’re off and running for another year. I’ll be updating monthly, although what I post here tends to be a censored version of what the club receives.

Happy Investing!

Ex-chairman Ralph