“A stock pick is when an analyst or investor uses a systematic form of analysis to conclude that a particular stock will make a good investment and, therefore, should be added to his or her portfolio” Wikipedia.

It’s here. The night I’ve been waiting for all year. Our stock picking dinner is tonight and the tension is ramping up across the mining industry. Think of it as the Davos Summit of mining. Twenty five seasoned veterans drawn from every facet of the global mining and exploration business –representatives from banking, research, geology, mining, journalism plus a couple of our parole officers- come together in a darkened room to select 25 companies that will set the junior resource market on fire for 2019. Just like we did in 2018.

The question I get asked all the time by eager investors, usually in a hushed respectful whisper, is “How do you do it? Please tell me? How did you guys managed to pick such a bunch of shite last year? How did you manage to perform so poorly and come up with a collective loss of 41%? What techniques do the chosen few apply to filter out the chaff from the wheat? How do we pick the rough from the diamonds?” Ah hem. Quite.

All good questions. And to be honest, I’m reluctant to go into the detailed methods we use. Why? Because there’s a real danger that if enough investors cotton on to our techniques and try to apply them in their day-to-day investing, the market could move; that’s how powerful our analytical skills are. Now, to be clear, I’m not saying which way the market will move -most likely it’ll go down- but you get the point. Think of us as influencers for better or worse.

But I do understand the important role we have as resource equity gurus. It’s a vital public service. We educate the masses, so that you, dear investor can benefit from the many decades of experience lodged in our hive mining mind. I’m willing to share just this once, so here goes with the top 6 stock picking tips.

- Pick last year’s bottom-placed stock. In our club, the loser was 88% down last year, so it can only go back up right? Brilliant in its simplicity, this is the approach I’m considering for 2019.

- Whatever you do, when choosing your company, DO NOT LOOK at its exploration or mining projects. They’re a distraction that can only lead you down the dark rabbit hole of technobabble and despair. Nobody ever looks at the exploration data until it’s too late so why start now? The corollary to that is never pick a company that’s about to drill holes. Any fool knows that disaster lurks just around the corner from the truth machine. Like Evrim, my pick last year.

- Pin the stock pages of the Northern Miner to a wall and chuck a few darts to come up with 3-4 picks. Potentially painful if you drop a dart and you may have to redecorate.

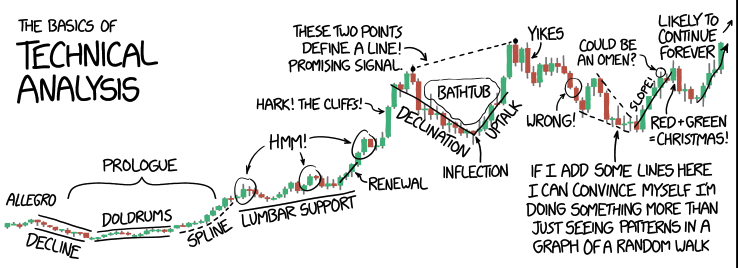

- Complex technical analysis. This heavyweight science-based approach looks at stock chart trends and breaks them down into mysterious chunks with fun names like reverse head and shoulders, falling wedges and breakaway gaps. The more of these you can spot, the better the stock. Here’s one I found that takes a deep dive into analysing a junior.

- Steal someone else’s pick. Good tactic this. Wait until a friend tells you what they’re investing in, piggyback off the research they’ve done and simply steal their idea.

- Choose any US listed gold stock with the word Patriot or American in the name-preferably both- and wait for Donald Trump to rile up the MAGA greyhairs again.

So there you have it. You now know as much as I do about selecting junior resource stocks. Impressive huh? Anyhow, good luck with your stock picking and don’t forget the old maxim: the best way to do make a small fortune in mining is to start with a big one.

I’ll be back with the full table of new picks for 2019 over the weekend once the hangover has gone. Oooh the excitement…

PS: I forgot the technique that won last year’s competition. Chose a stock that’s about to undergo a regulatory halt for months and won’t be trading. True, you can’t go up but you also can’t lose anything either and you’re insulated from extreme market fluctuations or crashes.

Eye-wateringly, testicle-crimpingly true. My broker evidently does it this way, ensuring that my retirement will be postponed another few decades after my death.

I feel for you.