Stock picking club update.

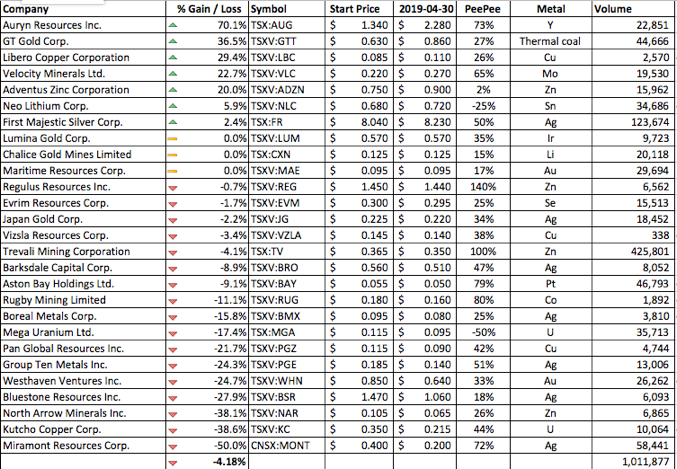

What follows is an edited version of my monthly junior mining update to the members of the steak-eating-red-wine-drinking stock picking club informally known as the “Get Rich Short Our Picks Club”. All names of members have been removed and some of my more abusive comments have been diplomatically edited out too. Which is a shame really. I’d love to leave them in so you can all see how bad this motley collection of mining experts is at choosing winners. Anyhoo, here’s the table, dateline end of April.

Greetings stockpickers,

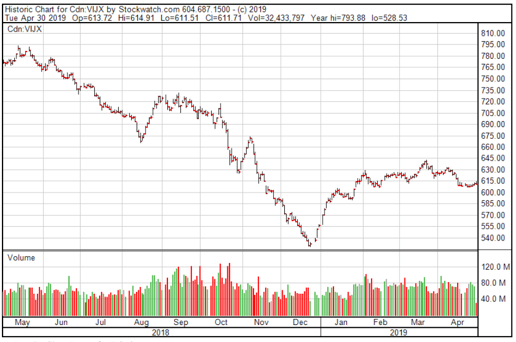

What a cheery month April was. And thank fuck it’s over. The TSX gold index (TITTGD) managed to drop nearly 10% from its recent high of 200-give-or-take-a-nipple, to a current level of around 180. The TSX Venture index continues to prick tease nobody in particular, drifting sideways as it has for the last 3-4 months. In technical chartist terms, I believe it’s called the “I’m-heading-for-the-door-screw-the-rest-of-you” pattern, definitely a positive.

To quote one of our members in an email earlier today: “The signs that we are in a bottom to this market continue. How much longer? I suspect the key signal is when (our fund manager friend) makes his first investment!” We really are in dire straits.

Last Monday, to remind us all once again of the dreary, fickle shitness of the mining markets -like you need reminding of head lice or food poisoning- Macquarie decided to rub salt into the open, festering mining finance wound and shut down their research, trading and sales teams across Canada including their mining desk. Joy of joys. That means even less finance houses for cash-strapped companies to waste their time presenting to. Oh well, it’ll make for shorter road shows I suppose. But I feel it’s perhaps a little short sighted of them to be leaving the mining space when it has such promising growth prospects after shrinking for the last 167 years.

But in all seriousness, one of our hallowed members was directly impacted by last Monday’s events at Macquarie. So spare a thought… lay-offs can be traumatic, often requiring extensive counselling to help the affected cope with the aftermath, particularly for those of us who still have jobs and have to work.

Sometimes life just isn’t fair. We’ll be slaving away through the summer, and he’ll be lounging on his moss-covered deck in his ill-fitting, mid-life crisis sarong, crocs and knee length socks, idly contemplating a jug full of delicious frosty Mojitos while planning his next gig, temporarily insulated from the resource gloom and doom. I suggest the club members pull together, use our contacts, and find him another job post haste. I’d hate for him to enjoy himself for too long.

On to cheerier stuff, and God knows we need a lift: who’s trailing the Hys and Lows pack and who’s scaled the greasy pole to ever-lasting temporary glory this month?

We have 7 stocks in the green, 3 unchanged including my gang of Ozzie slackers, Chalice Gold Mines, and 17 bottom sniffers for a Box Score of 7-3-17. Overall, the portfolio is down 4%, a swing of -7% from last month, reflecting the increased number of decliners. Last month’s Box was 16-2-9. Over the same time period, the TITTGD index is also down 4% so we appear to have effectively created a TITTGD ETF portfolio. God, we’re smrt.

Auryn remains in the lead, the Alpha dog of our scruffy pack of mongrels. Fortune has smiled on them yet again. Auryn has consolidated its gains, pulled up its panties, taken a deep breath and inched further upward for a 70% gain. I would congratulate the chap who picked them but I can’t bring myself to. It’s just too fucking painful. Really. Never.

Clinging desperately to the backside of the group, like toilet paper to the arse of the pub drunk, is Miramontypython Resources, which has actually staged a bit of a rally, climbing 20% this month from the awful depths of “Why-the-fuck-did-I-pick-this-ness” to “Not-quite-so-shit-ness”. Well done Miramont. I’m happy for you. Must feel good after so much below-averageness. Second place at the top is unchanged: GT Gold still showing a 37% gain, and busily cancelling any business it had planned with Macquarie I’m betting. Last month’s second from bottom, Pan Global Resources, has yielded the bitch seat to Kutcho Copper (-38.6%) and North Arrow Diamonds (-38.1%), who are tussling for second to last with only 0.5% between them, but Kutcho just takes it.

Speaking of North Arrow, I realised last month that some of our members’ picks have been perennially neglected in my monthly letters –never hearing a peep about them, negative or positive, because they’re always mired in mid-table drabness; the Crystal Palace of junior miners. Well worry no more! Each month I’ve decided pick on somebody new who doesn’t really deserve a mention. This month, North Arrow Minerals, third from bottom in our table, and Canada’s self-proclaimed “most active diamond explorer” with “a multifaceted project portfolio.” Nice gem stone pun there, I see what they did.

I’d venture that they’re Canada’s most active diamond explorer because they may well be the only diamond explorer with any money, so technically they’re not lying. Apparently “very few companies are looking for new diamond deposits and Canada remains underexplored.” There’s a reason for that, actually a lot of reasons. Perhaps your man who picked them should have asked around the table at the dinner before he made his pick, you know, taken advantage of the collected wisdom of our club before he made a fool of himself? But I will concede that they have a top-notch group of advisors.

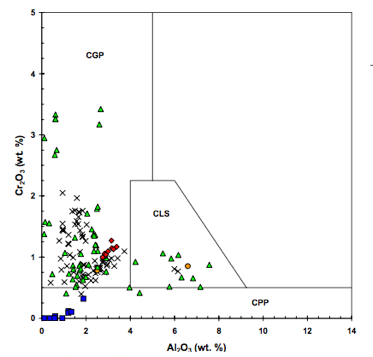

March was an exciting month for the beleaguered North Arrow shareholders (their next exciting month will be in 2021.) The company geos collected 447 till samples which were duly sifted, processed and picked by an army of kimberlite-sniffing elves at the North Pole, no doubt at a hefty cost per sample. Thirty five of the 447 samples returned kimberlite indicator minerals, ranging from 1 to 34 grains. Phew. I can’t wait for next year’s update on the microprobe analysis results and the inevitable graph of Al2O3 vs Cr2O3 for the clinopyroxenes.

Impressively, North Arrow have also recovered micro-diamonds from the Q1-4 kimberlite diamond “deposit”, which is located 9km from an Arctic coastal community called Naujaat, just east of North Pole lake (I shit you not). They seem to be counting on a higher-than-average proportion of piss-yellow fancy coloured stones to swing the project economics, and they’ve included an impressive picture of a bob-cat digger in the corporate presentation to make it look like they have a big hole, so that’s good.

They’re planning a bulk sample, but truth is the bulk sample results won’t be forthcoming until late 2020 or Fall 2021, assuming that is, that they can fund a pilot plant. Their cash position in October 2018 was $1.4m which dropped to $950k by January, a hefty burn rate with the summer field season approaching.

And that wraps things up for April. If there were any antibiotics I could take to cure the seeping market rash, I’d be ingesting great handfuls of the buggers. Sadly, Pfizer and its Big Pharma cousins haven’t come up with anything yet.

Sigh.

Ex-Chairman Ralph