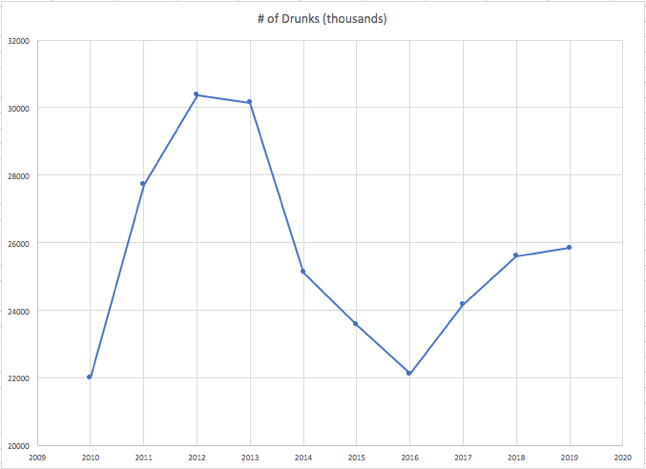

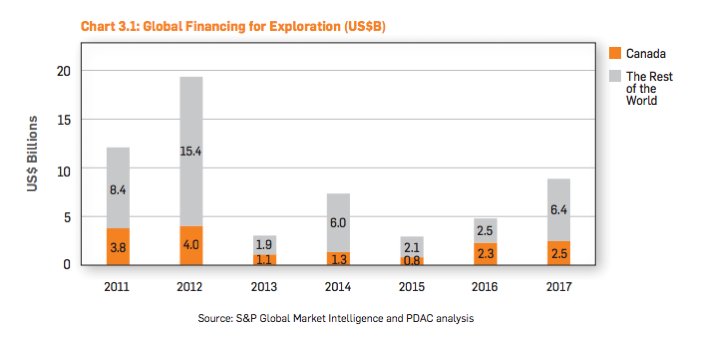

The presence or absence of PDAC crowds is something of a bell-weather for the state of our industry. It correlates, in part, to how much money we’ve collectively raised in the last 12 months, and also how the coming year of global mineral exploration activity is going to look. Attendance matches the global exploration financing figures quite closely, albeit with about a one year lag. Which doesn’t bode well for the business of discovery in 2019. PDAC compile convention attendance figures on their website, which I’ve graphed below for 2010 to 2019, alongside the global exploration financing stats from 2011 to 2017.

Source: PDAC website.

Source: PDAC and Oreninc.

Our numbers peaked at just over 30,000 attendees in 2012 and 2013, coinciding with the 2012 crest of global exploration financing. Money raised hit rock bottom in 2015, reflected in the 2016 low of 22,000 mugs willing to brave the psychological and physical torture of Front Street in March. I remember that year. Flights and hotels were being cancelled for “non-essential” staff and companies were shopping their pre-booked rooms via their travel agents to anyone who wanted to go; in a good year, hotel rooms are rare as hen’s teeth in Toronto for the first week of March. The number of overseas delegates declined as explorers cut back the freebie trips to PDAC for their local geological teams. Which tells me that this year’s abysmal/horrible/awful/shitty (pick 3 of 4) financing environment will likely be matched by low attendance in 2020.

By the end of the PDAC, the crowd, such as it was, dwindled into the Wednesday morning diehards as the party circuit mass-hangover kicked in. When the hall opened at 9am on the last day, it was dead. I was sat on my expensive, rented chair at the booth, chewing on a breakfast of decongestant pills and amoxycillin, vainly hoping for a potential investor to come within shouting range.

I guessed (incorrectly as it happens) that attendance was down into the low 20-thousands; still a lot of people, but way off the 30,000-plus of a few years ago. But what do I know? The PDAC claims just over 25,800 attendees – up slightly on last year- were trudging around this year, picking up free pens and chocolate coins. The number of exhibitors was definitely up on last year. The Trade Show North seemed bigger, and the Investor’s Exchange took up the entire hall once again. Gone were last year’s seating/meeting areas, artfully placed to hide empty booth spaces. To me, this helps explain the 25,800 figure – it was booth staff that boosted the attendance.

This year, the PDAC grandees also decided to charge retail investors $25 to walk the floor. Seriously, $25 to come and talk to a bunch of dead men walking? Combine that with the massive/huge/terrifying/shitty (pick 3 of 4) decline in mining financings, and it’s hardly surprising that numbers seemed to be down.

Oreninc statistics don’t lie says Kai.

Our friends at the Oreninc.com website provide an increasingly useful service, tracking mining financings across the major markets. Their data, included in a recent PDAC report called “State of Mineral Finance 2019: At the Crossroads”, released to coincide with the PDAC convention, confirms what we’re seeing and hearing. It contains this ominous comment:

“While funding specifically for exploration remained above 2013 and 2015 lows, in 2018 it declined by more than 50% from a year earlier to represent less than ¼ of peak investment levels established in 2012. Also concerning is the 40% year-over-year drop in bought-deal financing for junior explorers to $0.6 billion in 2018, which is the lowest figure recorded in a decade and hints at a lack of sector confidence by large brokerages.”

Oooer…This less-than-subtle miserablism was echoed in comments from a corporate finance chappy I was corresponding with:

“We continue to see very challenging conditions in the traditional equity capital markets. Exploration/development financings YTD have been almost exclusively non-brokered offerings taken up by insiders + retail. Very few offerings YTD have raised sufficient funds to provide for meaningful field programs in 2019. Hopefully we’ll see an improvement in market conditions going into PDAC.”

Safeway. A great place to work.

Great. Time to get a job at Safeway, perhaps, as a “stock replenishment associate”.

There doesn’t appear to be much cause for optimism, to be honest. Anectodal evidence from colleagues on the law firm side of things reinforces how bad the financing environment is for the juniors. The partnerships are seeing little of the traditional brokered private placement legal work they’d normally expect to handle: no point in drawing up sub-forms if nobody’s financing. All they’ve done this year is mergers and acquisition work and private equity deals, which is great if you’re a mid-tier or major company but not-so-great for the little guys like us. Private equity sure as hell isn’t looking at the early stage explorers. It’s looking for advanced-stage projects; investments that they can monetise relatively quickly.

Over and over, I heard the same thing – the traditional financing model for our business is dead/broken/fucked/gone (pick 3 from 4). Some resource-focused hedge funds have folded and more may go as money shifts away from our sector. Why pay expensive fund management teams when you can set up an index-tracking ETF that pretty much runs itself? My friend, Joe Mazumdar, flagged this trend in a recent Kitco interview, correctly calling this market what it really is. An extinction event.

“The popularity of passive funds are causing capital to flow away from actively managed funds, particularly in the mining sector.”

I must take more drugs

To be sure, not everyone is as cynical or pessimistic as I am. Some writers attended a different PDAC, the happy bustling one in the the alternate money-verse, where the gushing streams of private placement cash come trickling down the rocks, filling up Lake Equity where the miners can still come to drink their fill. Everyone they spoke to was happy and busy, their booths thronging with cheerful young millennials, the vanguard of a wave of young investors coming back to the sector. I really must take more drugs.

So, I tell myself over and over, if I can get through this current downturn, I’ll be a seasoned expert, in demand for my knowledge of exploration and mining finance and marketing. I’ll be able to write my own ticket, drifting affluently toward retirement; a survivor no less. We’ll see.

This year’s PDAC beautifully, succinctly and eloquently summarised. Makes me happy that I decided to leave on Tuesday afternoon and will do so in 2020….please keep up the entertaining work.

Thanks Tony. Did you read today’s offering? What is a geologist?

oops. Of course you did..