All The Rules You Need To Know.

Over the weekend, I was perusing archived computer files from my days with Anglo American PLC in London, 20 years ago. It was a bit of a lost cause- I was looking for digital photos from a trip I took to western Pakistan (see “My Project Went Boom“) to illustrate an upcoming print article on my misadventures there, but couldn’t find them.

The files are stored on a collection of dusty CDs, saved in a variety of file formats, some long since extinct. Tucked away in a folder, I spotted a Word file named “How to promote a mining stock”. It turned out to be a series of humorous rules for promoting a mining company, which are spot on even decades later. The piece is at least 20-years old and I’ve no idea who wrote it. It may well have been me but I don’t remember and can’t claim ownership for it, although it is along the same lines as my earlier blog piece “Mining stocks are crap”

To be honest, I suspect it’s not mine; there’s too much junior markets cynicism in the piece. Back then, I was still latched firmly on to the warm bosom of Anglo American, well paid and with little or no exposure to the dark side of the Canadian junior markets. There’s also a reference to a “portly chairman” that suggest to me a UK provenance for the piece. Anyway, I’ve taken the liberty of updating it a bit, adding a couple of rules of my own, and have removed some of the less “PC” bits. If you wrote it, or you know who did, drop me a line through the Comments section.

Rule 1. The Press Release

Put out frequent press releases, at least one a week. Junior stocks move on what is called “news flow”. Any time someone in management flies to the project, if one of your geologists collects a sample, or if the company next to your project gets good assay results, TELL THE WORLD and use ALL CAPS if possible. Every shareholder knows in their bones that they shouldn’t really be holding your stock so you have to convince them that you’re doing really important stuff; disruptive stuff. And quote the chairman. Warm, fuzzy reassurances by a portly chairman, preferably a retired senior military officer with a hyphenated surname, are guaranteed to deter investors from selling. Lieutenant Colonel Sir Crispin Cholmondely-Harkers must be trust worthy, right?

Rule 2. Show People Rocks.

If you’re being interviewed on TV, or presenting to a conference audience, always take a large piece of rock or drill core and wave it around imperiously. Tell the audience that it is a very rare piece of vermiculated-pyroxene-gabbro-with-disseminated-alabandite. Don’t let anyone touch it, and never explain where it came from. Let them assume that because you are holding the rock, and you are talking about the company, that the two are connected. The fact that it came from your garden is not relevant.

Rule 3. Your Deposit Is Always Huge.

Always superimpose the outline of the world’s largest copper deposit on the map of your property, plus a silhouette of the Empire State building, to show how enormously huge your non-existent deposit could be if it was there, which it’s not.

Rule 4. Use Closeology.

Announce loudly, or in an ALL CAPS press release (see Rule 1), that you are exploring/drilling/mapping adjacent to a property where a large and more famous company is working. They’ve found what might be a Tier 1 deposit (see Mining Clichés Explained). Now, your geology may be totally different, and there may well be a terrane-bounding fault between the 2 properties, but so what? Very few retail investors know the difference between geology and geography, so this technique can work surprisingly well in giving your property an undeserved aura of credibility.

Rule 5. Know Your History.

The more grand claims you can make about how much gold, platinum, copper, emeralds etc. was produced in historical times by the Romans, Greeks, Egyptians, Incas, Chinese and so on from your property, the better. Include a few photos of some leaf-filled hollows in the ground, or a musty old cave entrance, to highlight the presence of “ancient workings”. Make it clear that the ancients were amazing prospectors but without modern mining equipment they could never have got it all out, so there is still plenty left for everyone.

Rule 6. Use Maps.

Always include lots of pretty coloured geological maps in the annual report and presentations. For maximum effect, draw lots of big bold lines and circles on them and call them trends. This impresses the hell out of people. Big maps in TV studios, or on small tables, are particularly effective as it implies the project is so large that it can’t fit on a small map. Hopefully, no one will ask why you brought a 1:500,000 scale map and not a 1:5,000 scale.

Rule 7. Use Antiques.

Your annual report should always include photographs of gold antiquities from the local museum of indigenous artefacts. It will lend a very persuasive but totally spurious air of intellectual credibility to the project (see also Rule 4).

Rule 8. Helicopters Are Good.

Always show photographs of planes and helicopters in the annual report, preferably yellow or red ones, with something hanging underneath that could be high tech (although actually it’s a net carrying a chemical toilet to the drillers). I don’t know why, but everyone does so it must work.

Rule 9. No Donkeys.

Never show a photograph of a donkey in the annual report. People associate them with snake oil salesmen from the American Wild West days, which is far too close to the truth.

Rule 10. Local People Are Good.

Always show photographs of happy smiling locals in a group, or tending a lush vegetable garden, with at least one carrying a chubby baby sleeping happily in a chest sling. This gives the project a patina of benevolent third world development even if it’s only the local mayor who will get rich.

Rule 11. Use Technical Jargon.

Make all press releases highly technical with lots of long words, long meaningless drill hole numbers, baffling intersections, grades and rock types. And be sure to mix up your units. For example, quote a drill intersection like this: “4ft 6inches apparent width running 2% copper, 6ppm gold and 3 pennyweights silver.” On no account should you include anything useful that could be used by anyone to make a proper analysis of the data.

Rule 12. Avoid Company Finances.

Keep press releases firmly dedicated to technical issues. Never talk about detailed company finances, because you have no money.

Rule 13. You Always Own 100%.

When talking about financial projections, always talk about the project as a whole. Never remind investors that the company only owns 15% of it which will revert to 1.5% royalty by June unless you spend $3.6 M on drilling by then, money you don’t have (see Rule 12).

Rule 14. Exaggerate.

Financial projections should be based on the most optimistic metal prices you can find, at least 25% above spot price, and they should be pre-tax with an unrealistically low discount rate. Always label them “conservative”.

Rule 15. No Dilution.

All projections should be based on 100% extraction of the ore, and no losses of metal in the mill, smelter, refinery or the metallurgical manager’s trouser pocket.

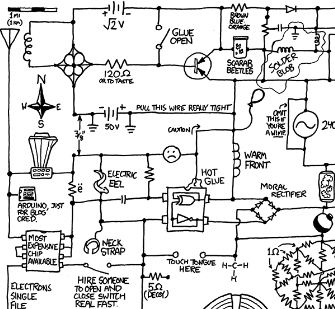

Rule 16. Talk Technology.

Remind investors that you are using the latest computer technology and blockchain-based artificial intelligence (as opposed to real intelligence). They will assume that everyone else is still using hand calculators or even slide rules, and haven’t discovered 3D modelling software yet.

Rule 17. Be Disruptive.

A good trick is to suggest that you have some technology up your sleeve that no one else has. The most plausible ones promise better recoveries or the ability to find metal that no one else can. The name of the technology should include some or all of these words: pyro, hydro, metallic, e-anything, orthogonal, heterogeneous, bio, techno, leach, molecular, sulphidic, oxide, blockchain, cloud and bacterial. The word order is not important.

Rule 18. Find A Pet Academic.

The board should include a couple of university lecturers or, even better, a Professor. They will be delighted to fly business class and have people listen to them while they drone on about Archean orogenies. The presence of academics is proven to increase the fund-raising power of a company by several orders of magnitude. And because academics get paid so little, they’re happy with anything you pay them, so you can keep the non-exec’ compensation to a modest level.

Rule 19. Avoid Success.

On no account actually find anything or even worse, go into production. That removes all the blue-sky potential of the company at a stroke.

Rule 20. You Need An Easy Life.

Never forget that the objective of the company is to raise money for the benefit of the directors. It is not the aim of the company to find anything. That makes life far too complicated, and forces management to manage something; a disastrous state of affairs for all concerned.

Rule 21. Pumpers Are Good.

Always find a newsletter pundit or internet tipster to back your cause to the hilt with repeated bulletins to their subscribers. This can be done by flying the writer business class to the drill site, putting them up in a five star hotel, inviting them to drink a lot of whatever the local spirit is, showing them a few rocks, and giving them a few free shares.

Rule 22. Use Clichés.

Remember to use clichés. They are your friends. Punters like clichés and will back up the truck and fill their boots with your stock if you use enough of them. (see Mining Cliches explained)

Rule 23. Appeal to Patriotism.

Remember, your country needs your undiscovered mine, because someone else’s evil country is trying to cut off the supply of whatever it is you’re proposing to mine (see Rule 20) and corner the market. Investors respond positively to seeing their country’s flag on a website or in a corporate PowerPoint, and will soon come to think of you as an heroic square-jawed patriot standing fast against a sea of thieving foreign johnnies, so use the flag everywhere.

Rule 24. Buy Your Own Stock.

Just don’t buy a lot of it. A constant trickle of small 500-share purchases filed in your insider trading reports looks good to investors; the more trades the better. Buying a block of shares in a private placement looks great to investors too. But remember, if you do buy a piece of a PP in your own company, make sure to exercise and sell enough warrants or options well ahead of time to cover the cost of the investment. On no account should you use actual savings for such a lunatic act (see Rule 20).

Rule 25. Use Social Media.

Social media is incredibly important, more important than making an actual discovery, because it gives investors the impression that you’re doing something at that moment in time (which of course you’re not). Make sure to Tweet incessantly about everything, no matter how tedious. Use Facebook, Instagram, Pinterest, Youtube and LinkedIn and any other social media feed you can find as often as possible. Content is irrelevant; what’s important is that your company is on social media. When you’re travelling, send out photos of your breakfast, a cute stray dog, your hotel room, or the line up at check in so investors feel sorry for you and your sad, lonely life on the road as you work hard to take care of their investments. And use lots of hashtags to give the impression that you’re tapped in to a vast network of global mining types who follow your social media feed.

So there you have them. Twenty five rules on promoting mining stocks, written mostly by someone else. If you can think of any to add, let me know!

One Last Thing..

If you like what you’ve just read, don’t forget to subscribe for update alerts via the handy little subscribe window on the urbancrows.com home page, and tell your friends about it. And your family. Tell everyone you meet.

I laughed, I paused and then I cried a little. Too true, now I need therapy.

Just a short question ; Shouldn’t ‘a terrane-bounding (sic) between the 2 properties’ be ‘a terrane-bounding (fault) between the 2 properties’ OR ‘a terrane-bounding, (incredibly good, lystric, increasing with depth, duplicating and mineralizing conduit) between the 2 properties’?

yup.. it’s called a typo. My brain kept reading the word fault after “bounding” despite it not being there.

Block chain references and social media in a twenty year old document?

As I said in the intro, I took the liberty of updating it and adding a few rules of my own. Hence blockchain.

I literally ‘laughed out loud’. Thank you for sharing your humorous insight on promoting mining stock….subscribing to urbancrows for sure.

Thanks!