More from the world’s greatest stock picking club!

Greeting Stockpickers,

It’s time for another look at how Hys and Lows, the world’s greatest mining stock picking club, is faring as we drift soggily into Fall. The following is an edited version of my monthly note to the club members, individual’s names redacted.

The Rules

First, the usual reminder of how our much envied club works. We meet in late January to quaff flagons of fine wine, mourn the state of the industry, and pick stocks. It’s not a club, just a casual once-a-year gathering of 25 or so knuckle-dragging hairy-palmed mining people at an overpriced steak restaurant in downtown Vancouver.

Everyone chooses 1 mining stock. It can’t be a company you work for, and it can’t be halted or pre-IPO. At the dinner, whoever chose the stock that went up the most over the year is declared the winner and they eat and drink for free. Everyone else has to bring a $100 bottle of wine and the loser gets to wear the toilet-seat-of-shame.

We’re Clever, Really.

We continue to believe, naively, that we know stuff -special insider stuff- about the industry, hence we can make really well-educated guesses about which stocks might do well over the year. And every year the market gives us a good kicking.

Kitsap.

The first second

third of the month is upon us once again, and I find myself devoid of

inspiration, staring at a blank word file as the cursor winks at me. Call it

writer’s block, call it age-related declining IQ – whatever the reason, it’s

not happening for me.

I could write about the weekend’s trip to Poulsbo, Washington, a quaint seaside town on the Kitsap peninsula that’s home to the last, reclusive north American Vikings. (It’s a shame we can’t use place names in Scrabble because I’d win every time after last weekend.) But nothing particularly interesting happened other than my dog ate a rotten crab on the beach, my wife bought some liquorice and I picked some quince to make preserves because nothing beats candied quince on a charcuterie plate. Gripping stuff.

Beer. The Solution Is Beer.

The solution to my literary inertia is obvious. Beer. Townsite brewing Suncoast Pale Ale to be specific. Leaving aside the irony of calling a Pacific Northwest beer “suncoast”, it’s quite a nice drop. The brewers have eschewed the Portland-hipster-style intense hop colonic in favour of an English style Pale Ale (a mere 25 IBUs) more suited to my parochial and uneducated palette. And the can is tastefully decorated with a stylised drawing of a car ferry which reflects the weekend’s travel quite well.

I Have A New Job

I did change jobs during September, which is a moderately interesting event as long as you’re my mum. After years of successfully avoiding managing anything, I’m now President of Aftermath Silver*, and the proud occupant of a small grey office on the 15th floor of the UK building with seagull shit on the window ledge. *(https://urbancrows.com/2019/05/21/how-to-promote-a-mining-stock-25-rules/ See rule 20)

My view is depressing. I look across the alley at a corner office, replete with filthy blinds and grey paint, that looks even pokier than mine.

So far, I’ve only seen the back of a balding head owned by the occupant of the office. However, if he’s looked my way, he may well have seen me in my boxers, changing out of my sweaty cycling gear into my office duds. Lucky him. I have to tuck myself away behind my bookshelf when I’m disrobing, so as not to unnerve the young, female book keeper in the booth outside my door with a quick flash of my ripped, 56 year old dad-bod.

Enough Blather. To Business.

September saw Eric Sprott invest millions more into our sector. Yes, the benevolent Mr Sprott is now officially the Fairy God-Buyer of the junior miners. While other investors and commentators on kitco chatter on about gold hitting $10,000/oz -nay, $20,000/oz- Mr Sprott has been extremely busy investing his money, close to $180-million by the end of August. All power to him.

Flitting from stock to stock, dressed in a spangly-but-overtight tutu astride his well-muscled white Magic Money Unicorn, he’s bestowed another $69-million worth of enchanted fairy dollars onto the poor, down-trodden sector since the start of August. Mr Sprott has single handedly conjoured up a (temporary) sense of optimism in the sector. Companies that haven’t yet felt his warm, benevolent breath on the back of their necks, can but live in hope.

$69-million is a bit more than I can comprehend so I recalculated it in terms of something I do understand; Suncoast Pale Ale equivalents @ $4.15 a can, which comes in at 16.62-million cans of beer. Each can is 168mm long, so lined up end to end they’d stretch 2,792km. That’s one hell of session.

Let’s just hope we don’t all turn into rats and pumpkins when the investment clock strikes midnight.

So Who’s Winning?

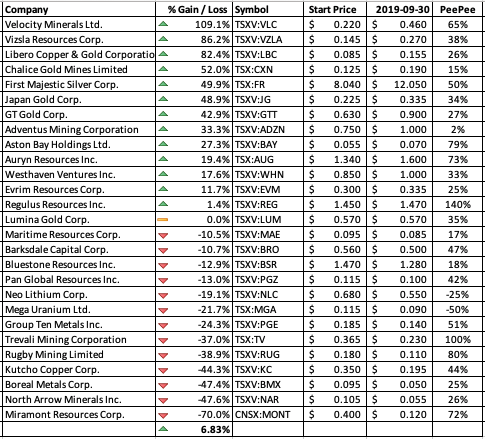

Down to specifics. The September Box Score is 13-1-13 (up-even-down), similar to last month and the month before that and the month before that -you get it. There’s a pattern emerging.

Our portfolio performance has declined since last month, mostly on the back of the $50 decline in the price gold over the last 30 days. Overall performance has declined 10 points from August’s +16.5% to +6.8% which just about matches the performance of the TSX Venture composite over the same period; a decline of 6%. The gold index declined by 12% so we’re still out performing the junior golds as a whole. The current closest guess for the overall portfolio performance (PeePee) is a 2% rise for the year.

In the lead, as predicted last month, is Velocity Minerals, up 109% y-o-y and currently trading at 46c. I know the management of Velocity quite well. I worked with a couple of their senior guys in the mid-1990s, first in Bulgaria and then Iran where we drilled a Carlin-type gold system in the northwest of the country. If anybody wants some embarrassing stories or a few hints as to where the skeletons are hidden, like which one of them enjoys a quick spot of Islamic cross-dressing in a black silk chador, send me an email.

Last place this month goes once again to Miramont… ah fuck it, you know the routine. How is it down there, Miramont? Hallo? You there…?

I’m Up To 4th Place

My pick, Chalice Gold Mines, has jumped 5 places to 4th place and now sits poised for further growth as the market recognises its rerating prospects. Ahhem. Quite why Chalice is up beats me, but I’ll take the gain. They did make a bland announcement about the appointment of one Mr Kendall as general manager corporate development in Australia, and I’m happy to report that, as befits an Ozzie, his first name is actually Bruce.

Chalice “are very pleased to have secured the services of highly regarded executive geologist Bruce Kendall, who (they) believe will make a significant contribution towards … future growth ambitions with his track record of discovery and executive profile.”

One day someone will call me an executive geologist. On second thoughts, perhaps not.

They bill themselves as a “unique, well-funded explorer” which is probably accurate in this market seeing as they have US$22m in the piggy bank. They also claim to be using a “Tier-1 (US$1B NPV) discovery model” whatever that means – a brave statement bearing in mind that there have been no Tier 1 discoveries in Australia for 10 years now.

Rugby Is The Biggest Loser.

The prize for the biggest fall this month goes to Rugby Mining, dropping 47 points from a 14% gain to a 33% loss. I guess those fickle bastard retail investors weren’t happy with 585m @ 0.62 g/t Au Eq. starting from 340m downhole. Rugby have a nice photo of the legendary Dr. Dick Sillitoe on their website taken while he was on one of their properties (I hope) examining something rock-like with a hand lens. If Dick’s been there, I’m in…

(Joking aside, the man IS a legend. If you’ve never been in the field with him, you’ve missed out.)

And finally, it’s a crying shame nobody chose Sun Metals this year. They’d be giving Mirasol a run for their money after the recent declines. It just goes to show, when you market a company stay away from the gratuitous use of superlative descriptions like “disruptive *discovery”. The market has a way of punishing puffery when the results don’t necessarily live up to the hype. Hopefully the team at Sun will prove me wrong in the long term but it’s a good lesson in holding off on the self-fondling until you really know what’s there.

*See rule 17: https://urbancrows.com/2019/05/21/how-to-promote-a-mining-stock-25-rules/

Till next month.

Ex chairman Ralph

Don’t Forget

This is NOT investment advice. Lord knows, a barrel full of blind monkeys throwing darts at the Northern Miner stock tables could pick a better portfolio than ours. If this piece hasn’t put you off my blog for life or forced you into premature baldness, please subscribe to urbancrows.com via the miserable subscription box that I carelessly placed near the top of the page. I’ll be sure to email you more slime about the junior miners from time to time, and I’ll even take requests for articles. Weddings, parties, anything. Capiche?

Going Home Deposit

Under My Thumb Deposit

Stupid Girl Deposit

Mother’s Little Helper Deposit

Do it.

Congrats on the job. I will be on the lookout for any signs of Rule #22.

I put all I could beg, borrow or steal* on Chalice. If it’s your pick, it can’t go wrong.

* iow, none of my own money

This was very entertaining although I skimmed over all the mining investment stuff – was that the best part? My big takeaway is that we should start a social media platform in my neighbourhood called Kitsap. And as a value-add for this comment, I act as my own scarecrow when shooing away seaguls, pigeons and crows from by Georgia Street (poop-free) window ledge. Should I put that on my LinkedIn? Asking for a fr…should I?