Shout out to Shovelnose

Greetings stock pickers,

What follows is an edited version of my monthly junior mining update to the members of the Hys and Lows stock picking club. All names of members have been removed. Which is a shame really. I’d love to leave them in so you can all see how bad our motley collection of mining experts and insiders is at choosing winners.

As the UK ponders a possible Brexit-related general election, and the UK’s electorate therefore have to ponder the real possibility of Jeremy Marx-Stalin becoming Citizen 1 in place of Theresa Won’t, I’d like to turn to happier things: the shitty resource junior market, a welcome constant in these turbulent times.

Down to business.

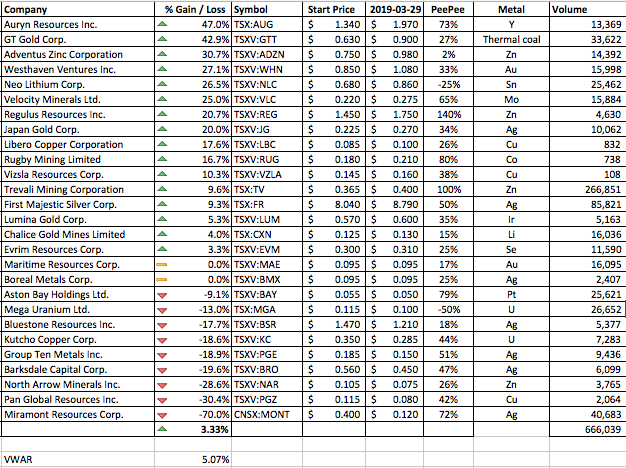

Here are the standings as of today’s close.

We have a new leader. Auryn Resources up 47%, and 26% gain on last month. The gentleman who chose Auryn didn’t actually attend the dinner- we selected Auryn for him. Fair enough, he sent us a list of companies to choose from, but the final pick of the list came down to an elite group of 1. Me, in my capacity as Chairman. That’s a roundabout way of saying he owes me.

Auryn bills itself as “a technically-driven, well-financed junior exploration company focused on finding and advancing globally significant precious and base metal deposits.”

As of the December 31st financials, they had $2.6M in current assets ($1.6m cash) and $3m in total liabilities. Which explains the “well-financed” bit I guess, and the $5m placement they just completed. Details, details…

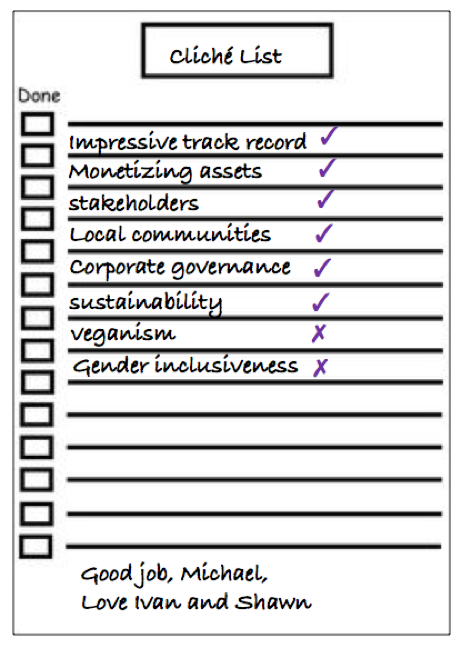

Impressively, they manage to incorporate every cliché under the junior resource website sun into 2 short sentences on their online blurb. The only things missing here are vegan diets and respect for all 125 known genders; gender being, as we know, a social construct.

“Auryn’s technical and management management teams have an impressive track record of successfully monetizing assets for all stakeholders and local communities in which it operates. Auryn conducts itself to the highest standards of corporate governance and sustainability.”

https://www.aurynresources.com/corporate/management/

Shovelnose. A fish.

There’s been a quite remarkable turnaround in fortunes for some of our other members this month. Fate, for once, has turned its capricious smile to our perennial whipping boy, last year’s loser, and anointed him with a big dollop of Sweet Holy Success Juice. Last month, his pick Westhaven Ventures was showing a lack lustre 3.5% loss, but lo and behold, they managed to pull a hot hole (12.7m @ 39g/t Au) from the depressingly-named Shovelnose project, sending the stock –for now- into resource Nirvana, and a gain of 27%. As a result, Westhaven has catapulted from 22nd to 4th place.

The ever useful Wikipedia tells me that the Shovelnose is a type of fish. Actually, there are two types of Shovelnose, neither particularly attractive as fish go. One Shovelnose is the smallest freshwater sturgeon in the US. It eats worms and larvae out of the riverbed mud, lucky thing. The other is a type of marine ray, which as we all know, have magnetic particles in their vestibular receptors, which are believed to be exogenous in origin. As I said, the depressingly named Shovelnose project.

I could understand calling it the Mahi Mahi project, or perhaps something fuck-off that invokes bigness, like the Whale Shark deposit, but Shovelnose, really? May as well call it the Genital Wart deposit. But regardless of the ill-advised Piscean name, congratulations to Westhaven; let’s not detract from their fleeting moment of happiness.

On the other side of fortune’s coin, jealously stewing over Westhaven’s gains, sits our new loser, a lonely and dejected shadow of a man, staring glumly into the overflowing chamber pot of life. Yes, he picked Miramont. What can you say about Miramont, our new tail-end charley, with a loss-to-date of 70%? Deary, deary me. A quite stunning u-turn from last month’s 5% gain for our future chairman.

They have a nice home page, by the way.

Bartleby’s on-line bibliography, quoting E. Cobham Brewer 1810–1897 “Dictionary of Phrase and Fable”, tells me that the word Mir’amont means “an ignorant, testy old man”. If the shoe fits, wear it I say.

Miramont’s recent drill program was an unqualified geological success. They drilled 3,700m of core in 9 holes and: “confirmed the basic geologic model that Miramont had developed for this district, significant mineralized drill intercepts thus far appear intermittent and discontinuous”. Love it. Confirmed the basic geological model. M-I-S-S-E-D is how the market saw it, and promptly performed a Brazilian wax job on Miramont’s share price, removing everything that wasn’t nailed down to expose the stinky bits.

Shame About the Drill Results

To their credit, management bravely put out the actual assay results which peaked at 1.5m @ 14.8g/t Au from 315m downhole with a skid-mark’s worth of copper thrown in (0.1%.) I was tempted to break out the spreadsheet model and run a DCF calculation on a conceptual resource of 156 tonnes @ 10g/t Au, with a ramp going down 300 vertical meters, but Excel wouldn’t let me. Even it knows better.

Our Chairman-to-be’s pick is also single handedly responsible for dragging the overall portfolio performance down from a gain of just under 6% to 3.3%.

And what of last month’s leader, Libero Copper? It’s still trading by appointment, but nobody’s booking any by the looks of it. Down from a 64% gain to 17% and 9th place. On no news. Nothing. Nada. Zip. Not even a financial filing. They do have a nice picture of copper pipes on their home page though, which is very reassuring. http://liberocopper.com/

Finally, in case you’re the one person living in a moonshine shack in rural Kentucky who’s not heard of the cluster fuck that is Brexit, with all its cluster fuckian implications, the peerless Jonathon Pie explains all at the link below:

And there we have it for March. Good luck for April and may the best “expert” win.

Chin Chin,

Ex Chairman Ralph

PS: our current end-of-March loser just e-mailed me the following:

“Dear Ralph, Thank you for pointing out the recent share price performance of Auryn Resources and the importance of your guiding hand towards its selection.

Your altruism is clearly evident even though your expertise towards your personal stock selection has yet to show itself. (Ouch, I deserved that, Ed.)

As for MONT, one of my favourite mantras, which clearly applies here is, ‘if you’re going to fail do so early’ and I have clearly achieved that end.

All is not lost, as the company still has $3M in the till but will clearly have to re-visit the drawing board and pivot to a new project, hopefully in time for Christmas!

However my most immediate strategy towards the pool is to count on the misfortune of others as I count down the days until I get to experience the sense of schadenfreude that I’m sure everyone involved in this sector has guiltily enjoyed at one time or another.

Yours, A. Loser.