Warning. This blog post/rant contains black humour about various things including my dad who’s not very well. If that’s not your thing, look away now.

The Rules

It’s time for another look at how Hys and Lows, the world’s greatest mining stock picking club, is doing now that winter’s arrived. The following is an edited version of my monthly note to the club members, individual’s names redacted.

Regular readers of my blog (why, oh why?) know how our uber-elite mining equity club works. We meet in late January to drink wine, pretend we understand the industry, and when we’re good and drunk we each pick a mining stock.

It can’t be a company you work for, and it can’t be halted or pre-IPO. At the dinner, whoever chose the stock that went up the most over the year (up? ha ha, that’s a good one…) is declared the winner and they eat and drink for free. Everyone else has to bring a $100 bottle of wine and the loser gets to wear the toilet-seat-of-shame.

And Here We Go

Greetings stock pickers,

I was back in the UK last week for the 121-mining conference on the South Bank. It’s a good conference, although after the 20th meeting I was ready to abandon ship and head for the nearest Fuller’s pub. It was livened up significantly by my colleague’s sudden and painful kidney stone attack which saw him crawling across the road to St Thomas’ hospital in the wee hours of the night, begging for death to come and take him.

A handful of our esteemed members were at the same well-attended conference. The mood was moderately positive, with some money waiting to be deployed to the right projects/companies. After the show, I drove up to Yorkshire for 5 days to visit my ailing dad. He’s 88 and is now unable to walk and house bound.

Actually, he’s lucky being stuck indoors. He doesn’t have to listen to the public whining incessantly about Brexit at the Tesco checkout while buying their cheap (for now…just you wait) ciggies and a nice bottle of tooth-rotting prosecco.

Everywhere you bloody go, the Brexit/general election fuckery is sucking out the brains of the Great British public. I can’t imagine living there and having to endure a media diet of that shit 24/7. I’d be tempted to shoot myself if the UK allowed gun ownership, which they don’t, thank God. Brexit-related suicides would be through the roof if they did.

Jeremy “cuddly old Marxist nationalising grandad” Corbyn, Boris “upper class twat buffoon philanderer” Johnson, and the perma-angry Scottish nationalist garden gnome named after a big fish, Nicola Sturgeon, are all as bad as each other. FYI, I’m not going to dignify Nigel Farage with a nasty description. Anything I call him only makes him look better.

What A Mess

Anyways, where was I? Oh yes, the party leaders. They’re all lying through their teeth, happy to go on TV and explain in short, earnest sentences how only they can unfuck the Brexit fuck-up. Just like Canada’s election, December 12th in the UK will come down to who you find least septic and loathsome, not who you like. A sad state of affairs, yessiree.

Meanwhile, in a delicious irony which is no doubt lost on Farage, the London Bridge terrorist attack was stopped by a Polish immigrant and a convicted murderer who’d served his sentence and had just been released.

Enough Brexit. What About The Mining Stocks?

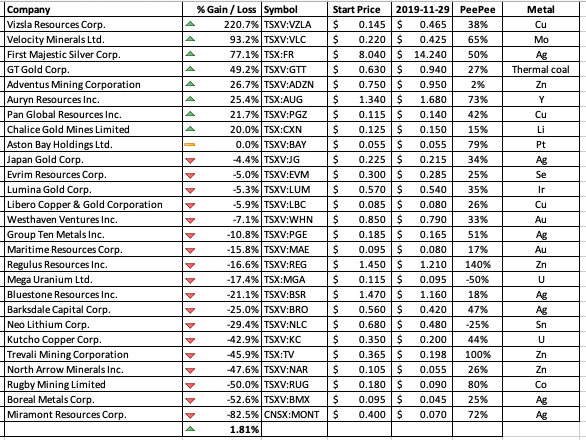

But on to the club. How time flies, eh? Seems like only yesterday we were pouring down expensive grape juice at Black and Blue, gnawing on steak bones while our gallant loser doffed the toilet seat of shame. And now here we are again, heading into the December home stretch, only a month or so away from our next gout-fest dinner date. The current standings are shown below. For what it’s worth, I picked Chalice Gold Mines, languishing in a semi-respectable 8th place.

First off, a quick look at our portfolio. What a… er…ho hum year it’s been for us. The TSX Gold index is up from about 186 at the start of January to a close of 243.7 last week – a gain of 31% year to date. The TSX-V composite is down from around 556 to a close of 531.8, or a loss of about 4%. Gold started the year at about $1,282 or so and is currently trading at $1,464 for a gain of 14%. In stark contrast, our portfolio is up a grand total of 1.8% on the year. ugh. Unless the market turns around PDQ, it looks like we’re going to finish the year about break-even on the portfolio, although there’s always tax loss selling to drag us down further. I can’t wait.

Miramont (aka. Itcanalwaysgolower Resources) has been languishing all year at the bottom of the charts. Our colleague who picked it has known for some time now, with 100% grim inevitability, that we’ve be buffing up the bog seat for him and giving it a good wipe down with Pinesol. The seat’s been put to good use this last 12 months, what with toilet repairs at my place and my incontinent uncle staying with me. They don’t call him the Uncle Pebble Dash for nothing.

Poor old Miramont. They’re down an impressive 82.5% at 7 cents, a further decline on last month’s temporary bottom. Ouch. Never mind. Cheer up, it’s nearly time for our loser to kiss goodbye to the fetid stench of the last place basement, break out the Wunderbaum and give the 2020 pick a crack. This time around, I hope he puts some bloody thought into his pick.

A Dog Is Winning

At the top of the 2019 midden heap, sharpening his steak knife, sits our man who picked the Johnny-come-lately Vizsla Resources Corp. Vizsla is skyward bound with a commendable gain of 221% year to date. On very little news, Vizsla has pushed Velocity Minerals into second place, cocking a leg, wagging its tail, and taking a good old steamy piss on it as it sauntered past.

VZLA’s newly appointed VP Ex. Charles Funk, picked up the Panuco silver property in Mexico. Feet under his new desk, he broke out the well-thumbed corporate copy of Stock Promotion For Dummies and turned to the chapter on “How To Take Bullshit Samples”. A few weeks later and lo and behold, they’re reporting a handful of channels across a known high-grade face or two, yielding up to 1kg/t Ag Eq.

In a Captain Obvious moment, management stated that they are “very impressed by these initial first high-grade silver and gold sampling results from San Carlos which highlight the potential of the Panuco district.” Bless.

So, there you have it. In the next thrilling monthly letter, I’ll be announcing the final standings. So until the end of December, I bid you good luck.

Yours as ever,

Ex-chairman Ralph

Don’t Forget

Don’t forget to regularly disinfect your toilet seat. Once you’ve wiped it down, be sure to cheer yourself up by subscribing to my awful blog, urbancrows.com. You can use the cheap and tacky subscription box at the top of the page that I wish I could properly format but can’t because I’m a techno-moron. The daft thing is, is I have 2 sons who’re both studying computer science and could no doubt help me but I’m too chickenshit to ask them. Remember kids, never admit to ignorance; always pretend you know the answer and everything will be fine. I’ll be sure to email you more incoherent ramblings from time to time, and I’ll even take requests for articles. Weddings, parties, anything.