I’ll Take Disclosure for $500 Please.

Urbancrows’ adult education series continues today with a post focused on junior mining company news releases.

Writing a good mining/exploration news release takes patience, skill, persuasive rhetoric and apparently, for some companies, a shit ton of old fashioned chutzpah.

They come in many flavours, ranging from 100% plain-vanilla factual to 100% artificially-enhanced, bubblegum fiction.

Whether it’s regulatory or technical, these are some of the different types of releases that you can find on the wires on any given day. Many were suggested by my eclectic and awesomely intelligent group of mining buddies who’ve seen just about everything there is to see news-wise given their hundreds of collective years of experience. (Thanks, Whatsapp & Twitter crowds, you know who you are.)

I thought it would be fun to also throw in a quick question suggestion to put to the IR person if you’re motivated enough to call the company after reading their latest issuance.

Mea Culpa

After nearly 20 years in the junior sector, I’m no innocent and I admit I’m guilty of writing more than one of these. You’d need the spotless, white soul of Mother Teresa (may she rest in peace) to have been involved in mining communications without writing one.

As ever, all opinions are my own and none of this wretched satire constitutes investment advice. Heaven help you if you think my random scribblings are perceptive enough to make you money. Enjoy, and if you’ve got a favourite I might have missed, pass it on via the NI43-101 compliant comments box at the bottom.

But First.. The Legal Disclaimer

A brief explanation of Disclaimers from a lawyer friend. Thanks!

Ever wondered why every release has an impenetrable disclaimer clinging to its bottom like clegnuts to a sheep’s arse? Forward looking statements, safe harbors, compliances with National Instrument 43-101 and other legalese annoyances, all hanging on for dear life under the real news.

My legal friend tells me they are intended to “reduce the liability of the company and its directors for the content of the release.” To which the obvious retort is, why couldn’t the content be… er.. better thought out in the first place, thus negating the need for disclaimers? But..details, details.

Ironically, for companies listed on the TSX-V Exchange, there’s only one compulsory disclaimer and it doesn’t actually protect the company, it protects the Exchange itself. Policy 3.3 rivetingly states that: “All news releases must contain… Neither the TSX Venture Exchange nor its Regulation Services Provider… accepts responsibility for the adequacy or accuracy of this release.”

Phew, what a relief, eh?! The Exchange is off the hook so we can all sleep more soundly tonight. Listed companies then take great care to cover their own butts, some more honestly than others:

Insert Company Name Here “shall not be liable for any claims, expenses, damages (including direct, indirect, special or consequential damages), loss of profits, opportunities or information arising from the use of or reliance on information contained in this [news release] and any inaccuracy or omission… or failure to keep the information current.”

If that doesn’t give you a warm fuzzy feeling that your investment is 24 carat, gold-plated and safe as houses what will?

The Dull Regulatory Release

Listed companies do all sorts of stuff that, by law, has to be press released. (yawn) This ensures (yaaaawnnnn) that shareholders are fully informed about shit like (rubs eyes…heads to coffee machine) share issuances, new board members (slumps in chair…), changes of auditors, director resignations (pinches leg), management appointments and so on. The full details (mouth open, drooling…) are set out in Disclosure Policy NI25-101b revision 2017: #126, Section 5, Paragraph 5.2a according to which, notwithstanding the aforementioned amendments, when publishing a relea (…..zzzzzzzzzzzzzzz slumps comatose on couch.)

Question for IR: Did you really have to publish that?

The Missing Or Delayed Release

“Big Gold Co Resources announces the start of drilling at the Gold Drip Project” reads the headline in May. Fourteen months later the drillers have gone home, the technical team is on leave, the camp was torn down, and you’re STILL waiting for news. Whatever can it mean?

Remember, the disclosure guidelines state clearly:

“Analytical results should be reported in a timely manner and always report both positive and negative results including ‘no significant assay’ intervals”

Ha ha ha ha etc, no fucking way. Your company drilled 15 dusters. Now, management has convinced itself with irony-free circularity that i) NI43-101 doesn’t apply to their results because ii) there was nothing material to report in them, so you don’t have to report that they missed! Problem solved.

Yes, the project may have been a “technical success” (see below) but that’s it. Remember. Always check the MD&A for the missing results- it’s where they’ll be hidden, tucked away from the prying eyes of pesky shareholders.

Question for IR: “How does your highly paid QP reconcile your lack of disclosure with the policy? I’ll hold.”

The Forced Retraction

They start like this. “Midden Mines Ltd announces that, because of a technical disclosure review by the British Columbia Securities Commission, it would like to clarify and retract certain disclosure.” And then comes the required list of corrections.

Your company has had a spanking from the regulators for being bad, bad little boys and girls; the longer the retraction, the kinkier the spanking.

Retractions usually happen when the company uses a word or phrase somewhere that’s included on the regulators’ “verboten” disclosure list.

This list, written by hand with the blood of a living QP on the tanned skin of a dead geologist, is kept in a locked strong room in the basement of the Ontario Securities Commission. The contents are known only to the regulators themselves and must not be revealed to mere mortals except when used to trigger a grovelling, painful retraction from a miscreant company.

It’s carefully guarded by a suicide squad of ideologically-pure, junior analysts who’ve memorised, Koran-like, NI43-101 and its companion policies.

Most of the time, retractions mean very little, other than the QP had a momentary lapse of concentration whilst drafting the technical language. Again, spend enough time in the business writing the damn things and one day you’ll do it too. But, sometimes they retract disclosure that’s SO dumb, SO far in contravention of the rules that my pet goldfish could’ve done a better job of writing the release and the company deserves what they get from the regulators.

The best protection against retraction is to have the full text of NI43-101 and its explanatory notes tattooed on your genitals (yes, they’ll need to be large, ah hem…) to refer to regularly during release writing sessions. Sorry, I couldn’t think of a sensible picture to illustrate this without getting banned from WordPress.

Question for IR: “Does it hurt when you retract it?“

The Technical Success

The dreaded “technical success” release can be a masterpiece of creative prose, lovingly crafted by the IR person, describing the excellent work done by the geologists. Whatever. It’s still a thinly-veiled, weasely excuse directed at their now penniless investors, explaining why they, the very clever geologists, were oh so right to drill where they did.

The lack of assay results in the first 2 pages is the give away; always skip to the end of the release and find the results table. It’s there, in extra small font hidden just above the Disclaimer (see above), which you now wish you’d read 2 years ago. The highlight is 1.3m at 0.03 g/t Au starting at 375m downhole, and they had to smear that to make it look better.

Question for IR: “What does smear mean?“

Announcing A Private Placement

The market is playing along, showing moderately apathetic keenness provoked by the gold price poking its nose above the rim of the toilet for the first time in 7 years. Your company needs cash. It’s time to announce a private placement (PP) and raise some Benjamins. A $3m PP at 7c with a 3-year, full warrant at 10c will do nicely.

In 2 months, when the PP is only 25% filled, they’ll announce an extension to the offering and a reduced 5c pricing.

Beware though. A poorly thought out PP release may accidentally explain the use of proceeds so you know exactly how they’ll waste your money. Then, when it closes, the entire PP is actually used to settle accrued debts owed to management.

Question for IR: “Are the insiders participating or are they happy with their 1.7m seed stock shares @ 0.0005c?“

Oh Look, A Squirrel!

Take some transient industry excitement or trend and magic it into shareholder value. Couldn’t be simpler.

Someone has made a big gold discovery in Yukon hosted by re-de-re-dedolomitized limestones adjacent to a major fault? Your company stakes something similar in Wyoming and puts out a NR because it stands to reason, right?

The commodity flavour of the month changes to Thallium? Your company changes its name to eThallium Mining. Nice.

But like toadstools on fresh, steamy road apples, the promote doesn’t last long, and guess who’s left holding the poop bag when it all dries out? Hint. Not them. Good luck discerning any focus to your company’s strategy, because management changes tack more often than I change my underwear, so roughly twice a year.

Question for IR: How do you keep up?

Visual Drill Results

The camp geo is on the sat phone to Vancouver calling in what they’ve just seen in the new core (“Great gobs of visible gold!”). A blurry digital photo reaches head office and now management can’t help themselves -they go ahead and publish a semi-erotic, boner-inducing news release before any samples have gone to the lab for assay.

You, the investor, are left to infer from 2 pages of sweaty geoporn that there’s a shit ton of copper / gold / silver in the holes and the assays are a mere formality. Bonanza grades assured, profits for everyone! Huzzah!

Except it doesn’t work that way, and the regulators take a really dim view of visual reporting, for good reason: it’s rarely correct. I’ve seen grown geologists bawling their eyes out 2 weeks after calling the directors to report sure-fire-can’t-miss visuals. Then the assays come back and the lonely, abandoned column in the table under “Au ppm” is emptier than than the Whitehouse ethics office. Now there’s a slightly less cheerful call to be made.

The unemployment tears only get worse when the phone rings a few days later. Yes, it’s Mr Nasty from the regulators asking for a detailed retraction (see above) or he’ll send round Big Vern with his tub of artisan-crafted organic sanded lube from Portland.

Question for IR: “Have you considered glasses?“

A Really Famous Consultant is Visiting Our Project!

Dr Insert name here is coming, so it’s a great project, right? Wrong. It just means the company can pay the US$2,500/day consulting fee to bring a living academic fossil to the site for 3 days to -hopefully- piss golden rainbows of liquid love all over the key outcrop.

7 shillings a day please.

Meanwhile, the project geologist is praying that 82 year old Dr Insert name here doesn’t die during the visit because they ABSOLUTELY DO NOT want to be the team that killed Dr Insert name here. If that happens, they will live in geological infamy -shunned at conferences, seminars and even the Brass Rail FFS.

If you’re an investor, whatever you do, don’t ask the company for a copy of the 5 page technical report from Dr Insert name here that politely, but firmly, let management know that the project isn’t what they think it is: i.e. mineralized.

Question for IR: “I can’t find the report from Dr Insert name here on your website. Why?”

Famous Geologist Joins Advisory Board!

Check. Copper. Check.

This topical variant on the “gushing breathlessy about a famous geologist” theme covers the appointment of a well-known amazingballs geologist to the mostly-redundant technical advisory committee.

Industry insiders know that the renowned geologist will have zero involvement going forward because, as flavour of the month, he/she is too busy signing up for other technical advisory boards that are more lucrative than yours. One word: bigger monthly fee and more stock options. Sorry, that’s seven.

Question for IR: “How much time will famous person be spending on your company for all those options? I’ll hold.”

We’re Rolling Back Our Shares 1 for 10

Where once you had 10 shares worth a total of 50c, now you have 1 share worth 30c. Where did the extra 20c go? It’s vanished, but how can that be?

Ta da! You’re a victim of the “Great Rollback Disappearing Value” magic trick, usually announced after close on a Friday (see below). Rollbacks make penny stocks slightly more palatable to the bankers and the regulators so companies can raise money via a respectably priced PP. As Investing News puts it without a hint of cynicism:

“If a company’s share price is declining so (far) that its only option to stay listed on an exchange is to consolidate, that may not be a sign of flourishing operations.”

However, it’s a rare occasion (think 2nd coming of Jesus rare) that sees a rolled back stock actually increase in value post roll back. They always drop. If you’re really unlucky, your stock (and you) will be rogered this way more than once before you finally see sense and use the share cert as cheap, moderately scratchy loo roll.

Question for IR: Did you just say I have 7 shares post roll back #4? What happened to the other 4,993? And is the cert 2-ply?

We Got Our Project Back!

This NR is the conjoined twin of the Technical Success abomination. Your company optioned its project to MegaGold, who spent $5.5m and 2 seasons drilling 26 holes, and found nothing. Nada. Zip. Now they’ve given the project back and walked away shaking their heads. What were they thinking?

But not to worry, getting the newly sterilised project back is the best thing that could happen to your company -AND IT IS SO BLOODY AWESOME for investors! Now they get to go it alone and try again, wasting their own treasury in the process! Huzzah!

Key IR question: Have you considered becoming a weed stock?

Unaware of Any Material News

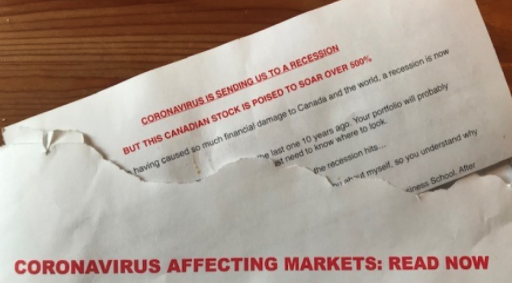

Your company is the target of an “unexpected” pump article by the website “Resource Penny Stock Bull Market Wall Street Winners”. The share price is up 48% at market open on olympian volumes. The regulators halt the stock. It went up too far, too fast, and now they want to know what management know about the promotion.

Why nothing of course. Silly question. Nobody in the company has ANY idea who’s published it, who paid them, how many cheap shares the pumpers own or what the piece said oh-no-sirree-not-us-never-what-a-gosh-darned-mystery, eh? They publish a brief release to that effect, the stock is un-halted and off it rockets again until the inevitable return to earth. I’m free… free falling… Remember, gravity always wins.

Question for IR: If management know nothing, why are they exercising options?

The Annual Roundup Release

The typical annual “exploration roundup and what’s happening next year” releases start to appear in October, like Walmart Santa, just in time to ruin Christmas for the kids when you have to explain to them why their RESP contains $3.40 and 22,500 worthless shares in 6 rolled-back juniors.

I’ve written roundups myself. Glowing reports of the year’s achievements and descriptions of what’s to come in the next 12 months (hint: dilution). Remember, when you write them always under promise and then make sure to under deliver. (Hold on… that’s not right…Ed.)

Question for IR: You’re going to spend $4.5m and you have $26k in the treasury. ‘Splain that again?

Options Granted to Insiders

It’s a brave company that publishes a news release purely to document the issuance of options or bonus shares to insiders. The unwritten rules say publish these on a Friday (see below.) It’s such an easy target for the critics. “You bastards are lining your own pockets! What is this.. a lifestyle company? I’ve lost $ INSERT FIGURE HERE and you grant yourself more options?“

So the best MO is to bury the option news at the end of a release that’s stuffed full of nutritious assay-result-goodness. Hopefully by the time the reader gets to the option grant they’re so happy they’ll phone the company up and demand that more options are granted to the team.

Question for IR: You guys are amazing. Why were so few options granted?

The Technical Report

Resource estimation, pre-feasibility study, exploration project 43-101 – whatever the report, the common thread is a 12 page bafflegab news release. It’s been written by committee; engineers, geologists and lawyers and only the most masochistic retail investor actually reads it.

me read that report.

Power costs, grinding indices, recoveries, strip ratios.. fuck me, the list goes on and on and on. To be honest, I’d rather sandpaper my nuts than wade through these releases.

As a kid, I once tried reading Tolkien’s hellishly dreary follow up to the Lord of the Rings, the Silmarillion. It’s turgid, like the Old Testament (he begat her she begat him), but it’s still a shit load more engaging than most technical report releases.

However, however…. investors can sleep a little more soundly knowing that most long technical releases have actually been pre-filed with the regulators who, hopefully, did their job and asked penetrating questions of the company ahead of publication.

Question for IR: “What’s the hourly variation in power utilisation over a continuous 24-hour operating period of the proposed SAG mill vs a reconditioned ball mill of similar throughput?“

We’re Selling An Exploration Asset

They’ve been exploring for years and have a project with a modest gold/copper/lithium/graphite resource. But now they need money to fund exploration somewhere else. So it makes perfect sense to sell the modest gold resource, leaving them with no projects, but they do now have the cash to explore again and find a.. er… modest gold resource. Rinse and repeat.

Question for IR: “Have you seen Groundhog Day?“

We’ve Arranged A Loan / Debenture

“Ah yes!” he said with a nostalgic sigh “The good old insider loan.”

They’ve run the company into the ground, paid themselves well, then when the treasury is empty, the insiders announce that they’re going to lend the company half a mill. Smart teams know that they should ONLY do this when they have a PP lined up for a few months time and they know they can pay themselves back with the minimum 6-month interest payment.

Remember, if they didn’t: a) charge at least 1% per month interest; b) throw all of the legal fees to paper up the loan back to the company; c) gorge on a mandatory “commitment fee” of $50k; d) chuck in a million bonus warrants; and e) give themselves the option of being able to convert to shares at a deemed price of 10c at any time, then they haven’t done their job.

Question for IR: “What the fuck?“

The Board / Senior Management Have Resigned En Masse

Like rats leaving a sinking ship, the company team has quit, leaving the President, or a (newly executive) director at the helm, to steady the ship. It’s hard to portray this in anything other than a really, really negative light.

Something’s gone horribly awry, bad enough from a business perspective that a group of reasonably intelligent, commercially savvy adults have all run away, leaving the slowest or the fattest behind to man the pumps.

Directors or management resign for all sorts of reasons – bad news is about to break; they’re ill or too busy on other stuff, or perhaps there’s been a nasty rift in how the board and management see the company strategy. But it’s a brave shareholder that stays long on a stock when the entire management team is doing a Captain Oates, unless the outgoing crew were schysters, in which case it’s a positive and you should fill yer boots. Capiche?

Question for IR: “Waddya mean you’re the cleaner?“

We’re Attending A Conference!

Yay! Break out the company credit card and gird the expense account! Thirty six other companies attending PDAC / 121 / MIF etc have just put the same NR out, subtly signally to their investors that there’s a major conference hangover session coming so best not to call management for a few days, eh… please?

To paraphrase an industry friend: “We get it asshats. You’re going to spend wads of shareholder money to travel across the continent to New York, or across the puddle to London, to pat each other on the back over a pint of Old Spunky’s Winter Caramel Porter just for a change of pace from the endless IR convention drunk known as “Let’s Crawl The Wine Bars on Burrard”.

Question for IR: “What’s wrong with Zoom?“

We’re Investing In Crypto Thingys

NB: I started this piece last year & this variant has become increasingly rare, thank God.

It’s crypto-bollocks time. If anyone can tell me the name of a resource company that successfully financed its exploration programs via a new crypto issue, I’ll eat my underpants. And that’s not a pleasant thought after last night’s lamb tikka masala with spicy lime chutney, no sir.

It’s educational to take a look at a couple of websites that track the decreasing flurry of new coin issuances; coinopsy.com and deadcoins.com.

Deadcoins estimates that at least 1,840 crypto projects have withered and died since late 2017. Bear in mind that many of the issuances were outright scams, designed to raise cash from investors who knew absolutely nothing about the technical side of the sector but were looking for a quick win, and ended up just enriching management. Hold on… that sounds familiar…checks notes…ah hem…

Question for IR: “Are you completely insane?” A. “Virtually.”

We’re Selling A Royalty

A royalty is “the right to receive a percentage or other denomination of mineral production from a mining operation.” There are many different kinds of royalty (known by 2 or 3 letter acronyms like NSR, NPI, NVR) all of which is incredibly dull, but well-loved by the expensive lawyers who write the dense legal descriptions.

The mining world is full of worthless royalties, created by enthusiastic management teams on shit deposits. It’s true that royalties on quality deposits are hugely lucrative, yielding millions in free cash every year. (As a knowledgable friend pointed out, there’s perhaps an argument to be made that they should only be called royalties when they actually start producing cash otherwise they’re really just glorified IOUs.)

Alas, the NSR that your company is trying -and failing- to sell, the one that their strategic advisor gave an “optimistic valuation” to, is 3% of production from a small oxide copper system high up in the Andes, where there’s no water, road, power or mineralization and even less interest. Good luck!

Question for IR: “I won’t live long enough will I?” A. “No.”

Mining Company Production Guidance

Another dull list. This time it’s tonnages, grades, planned production ounces or pounds, and forecast recoveries that are supposed to reassure you that your Company’s mines are buzzing along happily like a formula 1 car on jet fuel. Great rivers of precious metal are pissing out of the plant. The devil, as ever, is in the detail.

The missing tonnes are here somewhere. I know they are.

Always double check the figures against last year’s forecast to find out how badly things have been going. A mysterious loss of reserves that doesn’t match the tonnes and ounces produced? Ooops… bad resource estimation that won’t reconcile with reality. Metallurgical recoveries showing a nasty negative variance over forecast? Ooops… Plant not performing to spec perhaps.

So many potential problems and so few pages of NR to write them all down.

Question for IR: “Why did you delete last year’s production guidance from your news archive?”

Yeah, He’s Been Fired

The company announces that John Smith has left the company with immediate effect. The shorter the eulogy, the nastier the firing and if lawyers are mentioned, they stole something really important, most likely the treasury. Check the notes to the financials next quarter and read the section on significant risks.

Key IR question: “Did you cancel their 3.5-million options?”

The Friday Night Special

As a rule of thumb, if a release is published after market on Friday, you know it’s not good news. If a news release comes out on a major holiday -say, Christmas day– it’s even worse news and not even God can save your gangrenous investment now. Pay attention and read it closely. Remember to play the game “Spot the real news” because it’s rarely in the headline. Whatever the NR says, the truth is far, far worse and is buried somewhere near the end. Run away (again)!

Key IR question: “So we’re fucked right? Really fucked?“

Oh No, There’s Been A Fire.

This one’s rare but it should be re-read, and enjoyed over and over if you’re lucky enough to spot it in the wild and are NOT invested in the stock.

Some key piece of project infrastructure has burned to the ground in a mysterious fire. Vital data such as drill core, records, sample duplicates etc were stored in what is now a huge pile of smoking embers and skeletal, blackened filing cabinets resembling Mt St Helens in 1980. Ooops.

It usually presages a massive, wealth-destroying fraud that leads to a generational regulatory overhaul for the junior sector. One of the more famous examples was in 1997 when the core storage at Bre-X’s now infamous Busang project burned down, and we all know how that ended up for investors; pretty fucking badly, unless you happened to be short.

Key IR question: “Why is this connection so bad? What? You’re in Mauritius?”

And so endeth the lesson for today. What did I miss?

Don’t Forget

The Urbancrows blog is pleased to announce that interested readers can now sign up for e-mail updates via the NI43-101 compliant subscription box at the top of this page. If you can bring yourself to subscribe, we’ll mail you non-promotional articles from time to time carefully proof read within the context of the public disclosure guidelines. However, Urbancrows shall not be liable for any claims, expenses, damages (including direct, indirect, special or consequential damages), loss of profits, opportunities or information arising from the unlikely event that it fails to amuse.

Remember, there’s no place in civil society for racism -casual or institutional- and we all need to stand up to it when we come across it. The biggest lesson of my career- the privilege of travelling the world to bang rocks- is that when you scratch below the surface, we’re all the same person.

This article (or instruction manual?) should be essential reading for any aspiring young geologist considering a “career” in economic geology. I doubt whether the average “investor” would understand it or even care which is a pity. It has certainly encouraged me to increase my consulting fees !

As a letter writer, I had to read an awful lot of these. Another of my key indicators of bad news is if the PR was supposed to be about results, but led with social engagement. If you are telling me about your relationship with the locals, the rocks suck.

or the REAL relationship with the locals sucks and anything you can say about the rocks pales into insignificance.